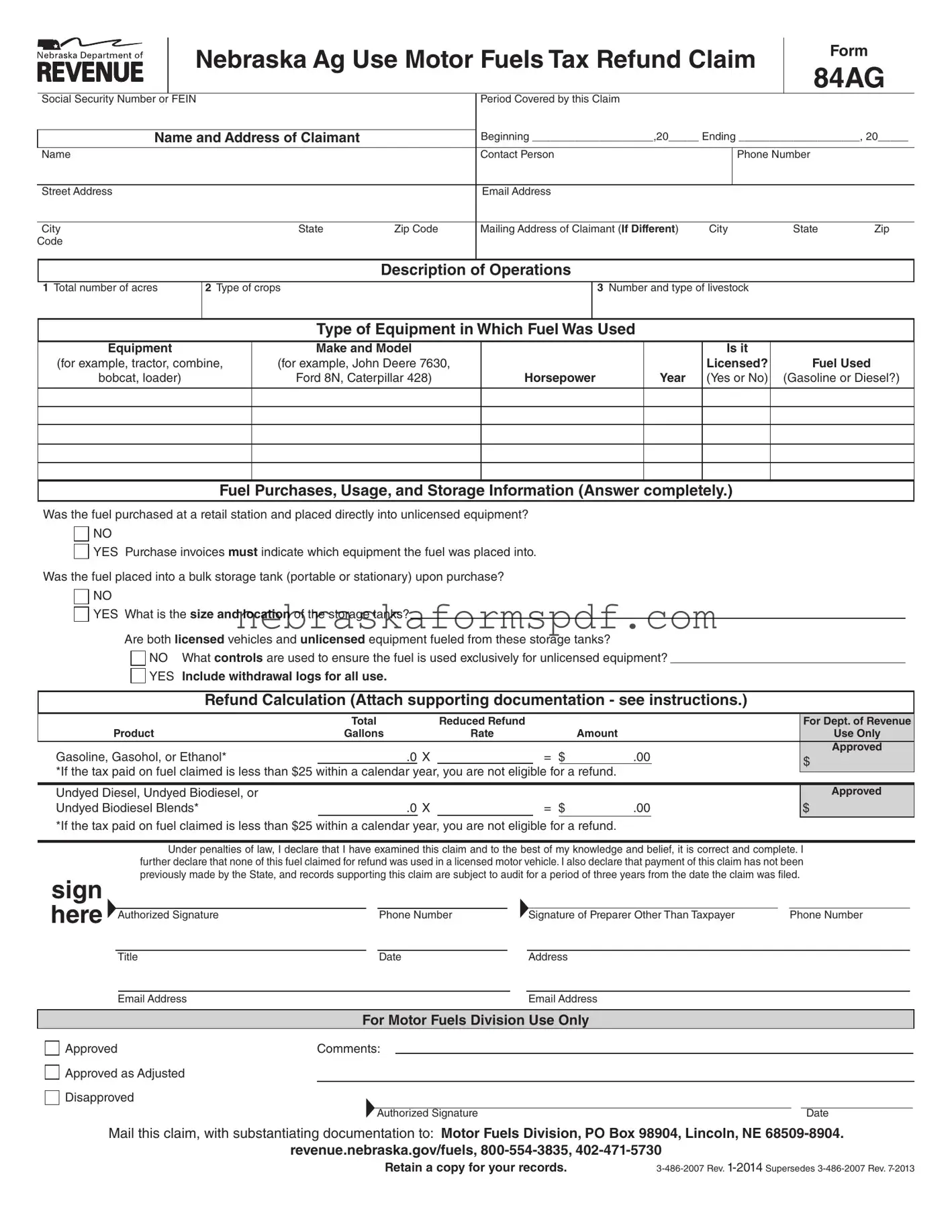

Nebraska Ag Use Motor Fuels Tax Refund Claim

Social Security Number or FEIN |

|

|

|

Period Covered by this Claim |

|

|

|

|

|

|

|

|

Beginning ____________________,20_____ Ending ____________________, 20_____ |

Name and Address of Claimant |

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

Contact Person |

|

|

Phone Number |

|

|

|

|

|

|

|

|

|

|

|

|

Street Address |

|

|

|

|

Email Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

Zip Code |

Mailing Address of Claimant (If Different) |

City |

State |

Zip |

Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description of Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Total number of acres |

2 Type of crops |

|

|

|

3 Number and type of livestock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type of Equipment in Which Fuel Was Used |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equipment |

|

Make and Model |

|

|

|

|

Is it |

|

|

(for example, tractor, combine, |

(for example, John Deere 7630, |

|

|

|

|

Licensed? |

Fuel Used |

|

bobcat, loader) |

|

Ford 8N, Caterpillar 428) |

|

Horsepower |

Year |

(Yes or No) |

(Gasoline or Diesel?) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fuel Purchases, Usage, and Storage Information (Answer completely.)

Was the fuel purchased at a retail station and placed directly into unlicensed equipment?

NO

YES Purchase invoices must indicate which equipment the fuel was placed into.

Was the fuel placed into a bulk storage tank (portable or stationary) upon purchase?

NO

YES What is the size and location of the storage tanks?

Are both licensed vehicles and unlicensed equipment fueled from these storage tanks?

NO What controls are used to ensure the fuel is used exclusively for unlicensed equipment?

YES Include withdrawal logs for all use.

Refund Calculation (Attach supporting documentation - see instructions.)

|

Total |

|

|

Reduced Refund |

|

|

|

|

|

For Dept. of Revenue |

Product |

Gallons |

|

|

Rate |

|

|

Amount |

|

|

Use Only |

Gasoline, Gasohol, or Ethanol* |

|

.0 |

X |

|

= |

$ |

.00 |

|

Approved |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

*If the tax paid on fuel claimed is less than $25 within a calendar year, you are not eligible for a refund. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Undyed Diesel, Undyed Biodiesel, or |

|

|

|

|

|

|

|

|

|

Approved |

Undyed Biodiesel Blends* |

|

.0 |

X |

|

= |

$ |

.00 |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

*If the tax paid on fuel claimed is less than $25 within a calendar year, you are not eligible for a refund.

Under penalties of law, I declare that I have examined this claim and to the best of my knowledge and belief, it is correct and complete. I further declare that none of this fuel claimed for refund was used in a licensed motor vehicle. I also declare that payment of this claim has not been previously made by the State, and records supporting this claim are subject to audit for a period of three years from the date the claim was filed.

|

|

|

|

|

|

|

|

|

|

|

Authorized Signature |

|

Phone Number |

|

|

Signature of Preparer Other Than Taxpayer |

|

Phone Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

|

Date |

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email Address |

|

|

|

|

Email Address |

|

|

For Motor Fuels Division Use Only

Approved |

Comments: |

|

|

|

Approved as Adjusted |

|

|

|

|

|

Disapproved |

|

|

|

|

|

|

|

|

|

|

|

|

Authorized Signature |

Date |

Mail this claim, with substantiating documentation to: Motor Fuels Division, PO Box 98904, Lincoln, NE 68509-8904.

revenue.nebraska.gov/fuels, 800-554-3835, 402-471-5730

Retain a copy for your records. |

3-486-2007 Rev. 1-2014 Supersedes 3-486-2007 Rev. 7-2013 |

Instructions

Caution: Only federal governmental agencies and buses for hire are eligible for the refund of tax on fuel placed into a licensed motor vehicle. All other users of fuel in licensed motor vehicles, regardless of how those vehicles are used, are not eligible for a refund of motor fuels tax.

Note: All refund claims are subject to audit for three years after the claim is iled.

Who May File. Any person requesting a refund of Nebraska motor fuels tax paid on fuel used in unlicensed equipment for farming or ranching purposes may ile a Nebraska Ag Use Motor Fuels Tax Refund Claim, Form 84AG. Prior to adjustments, the tax paid on the eligible fuel must be at least $25. This minimum must be

met within a calendar year for each fuel type.

When to File. Only one claim per month may be iled by any claimant. You must ile your claim within three

years from the date of payment of the tax.

Where to File. This claim, along with supporting documentation, must be iled with the Nebraska Department of Revenue, Motor Fuels Division, PO Box 98904, Lincoln, NE 68509-8904.

Basis for Claim. Appropriate documentation must be attached to the Form 84AG. Documentation submitted with the Form 84AG will not be returned.

Exempt Use of Tax-Paid Undyed Diesel, Gasoline, Gasohol, and Ethanol. Any person who has purchased and used tax-paid fuel for a qualiied exempt purpose may ile a claim.

Required Documentation. In order to support the claim, the following information must be included:

•A description of your operations must be submitted with the initial claim, and then on an annual basis; include the number of acres farmed, types of crops raised, and the number and type of livestock;

•A list of the type of equipment in which the fuel was used must be submitted with the initial claim, and then on an annual basis; include the make, horsepower, and other mechanical description of the machinery;

•Information regarding the fuel purchase usage and storage;

•Legible copies of fuel purchase invoices indicating the amount of tax paid, the date of purchase, fuel type, gallons purchased, and vendor’s name. If the fuel was placed directly into unlicensed equipment, the equipment fueled must be indicated on the invoice; and

•Legible copies of withdrawal logs documenting the date, gallons, and equipment into

which the fuel was placed if both licensed vehicles and unlicensed equipment are fueled from the same storage facility (refer to the Nebraska Motor Fuels Tax Refunds Information Guide for additional information).

If your documentation exceeds the Form 84AG space limitations, you may attach additional sheets of paper.

Specific Instructions for Calculating the Refund

Multiply the number of gallons claimed by the refund rate in effect when the fuel was purchased and enter the amount calculated. Round all gallon and dollar amounts from .50 to .99 to the next higher whole number. Round all gallon and dollar amounts less than .50 to the next lower whole number. If gallons are claimed for periods with

multiple refund rates, attach a summary of these calculations.

Refund Rates. The refund of the tax paid on fuel consumed in a qualiied exempt manner is determined at a

reduced rate. See the refund rate table for the correct rate.

Signatures (Original signature required). This claim must be signed by the claimant, partner, member, or corporate oficer. If the claimant authorizes another person to sign this claim, a Power of Attorney, Form 33, must

be attached. Any person who is paid for preparing a claim must also sign the claim as preparer.