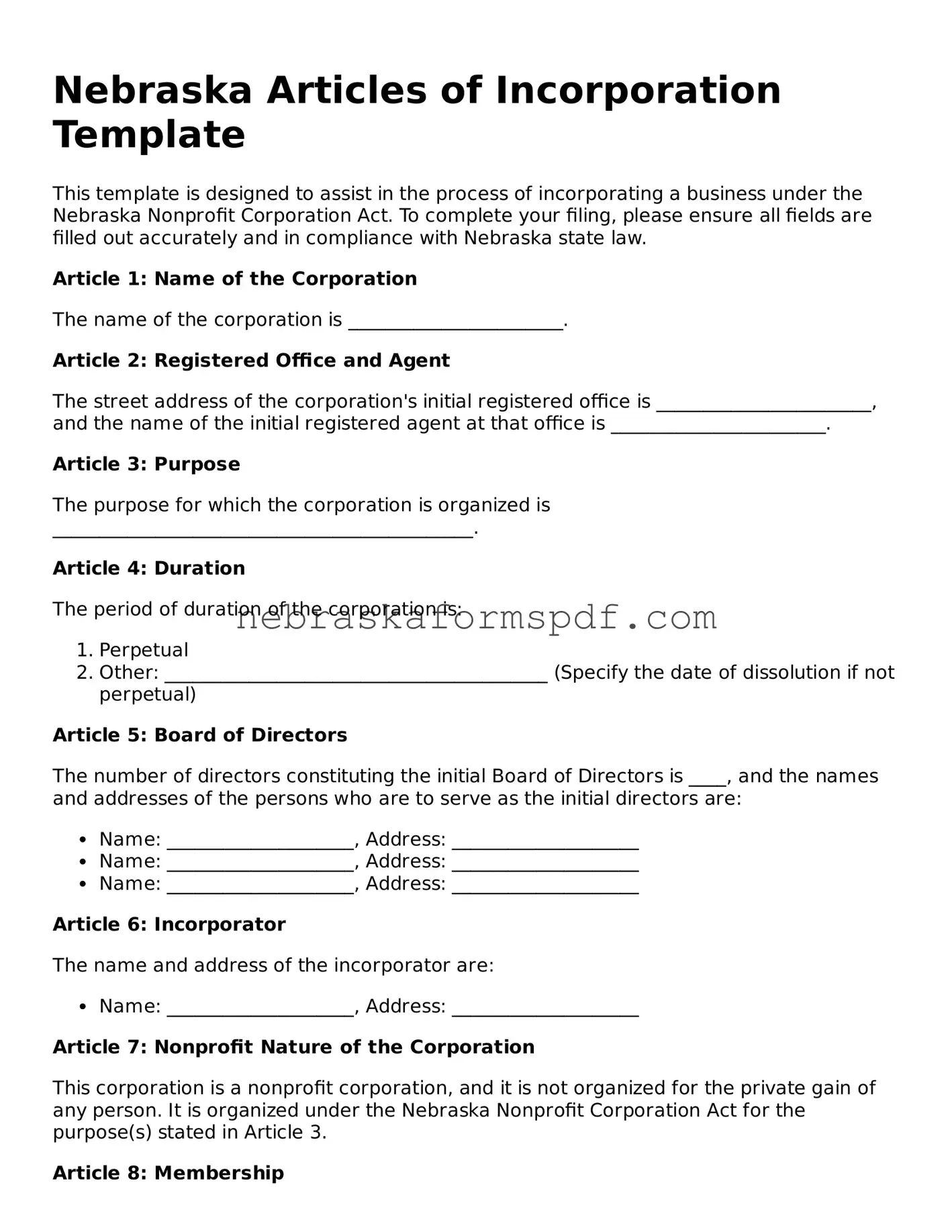

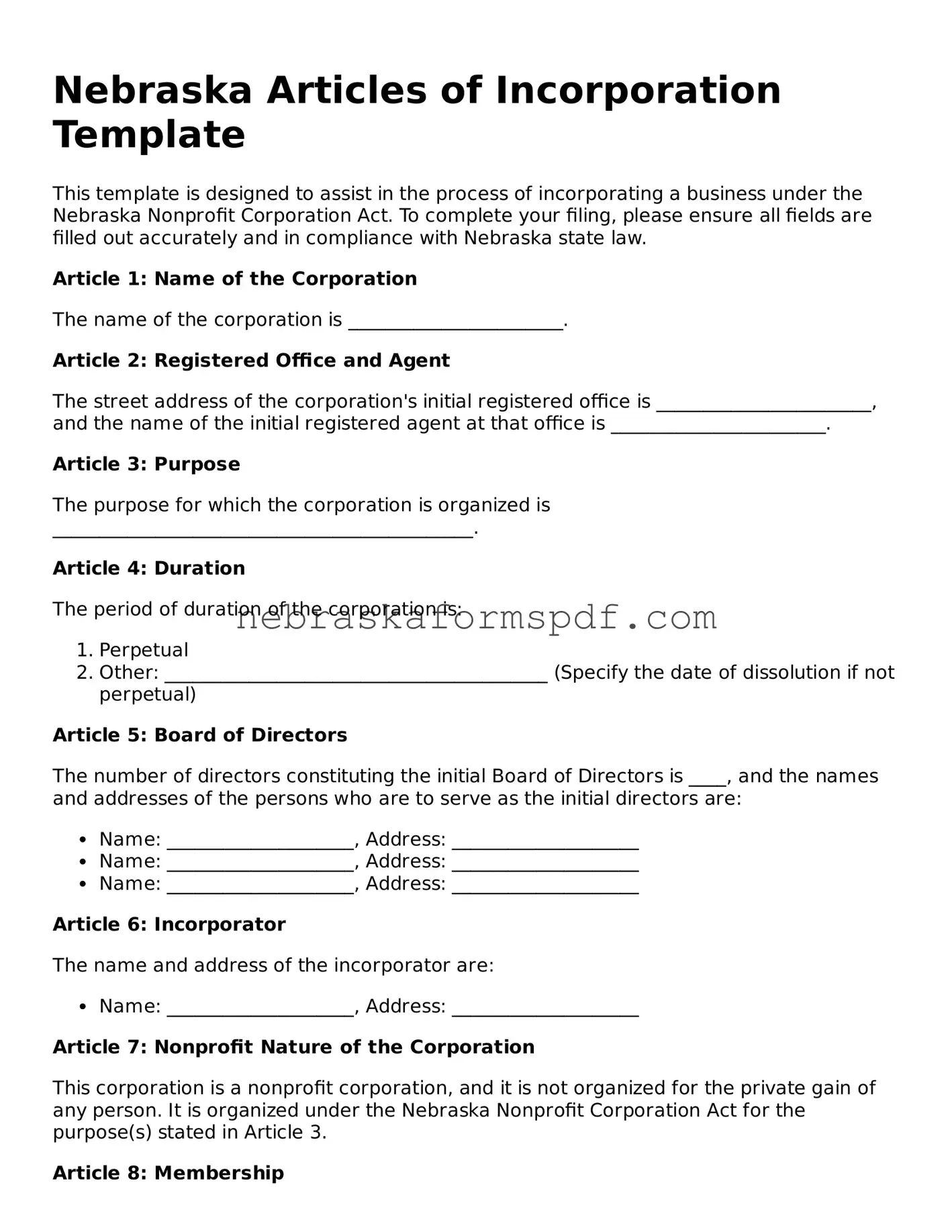

Fillable Nebraska Articles of Incorporation Template

The Nebraska Articles of Incorporation form is a legal document that officially recognizes the creation of a corporation within the state. This essential paperwork serves as the corporation's birth certificate, outlining basic information such as the company's name, purpose, and the details of its incorporators. By filing this document, a business takes its first step towards acquiring a legal identity, allowing it to operate and engage in a variety of transactions.

Open Editor Here

Fillable Nebraska Articles of Incorporation Template

Open Editor Here

Open Editor Here

or

Click for PDF Form

Don’t exit with an incomplete form

Finish Articles of Incorporation online using a quick, guided process.