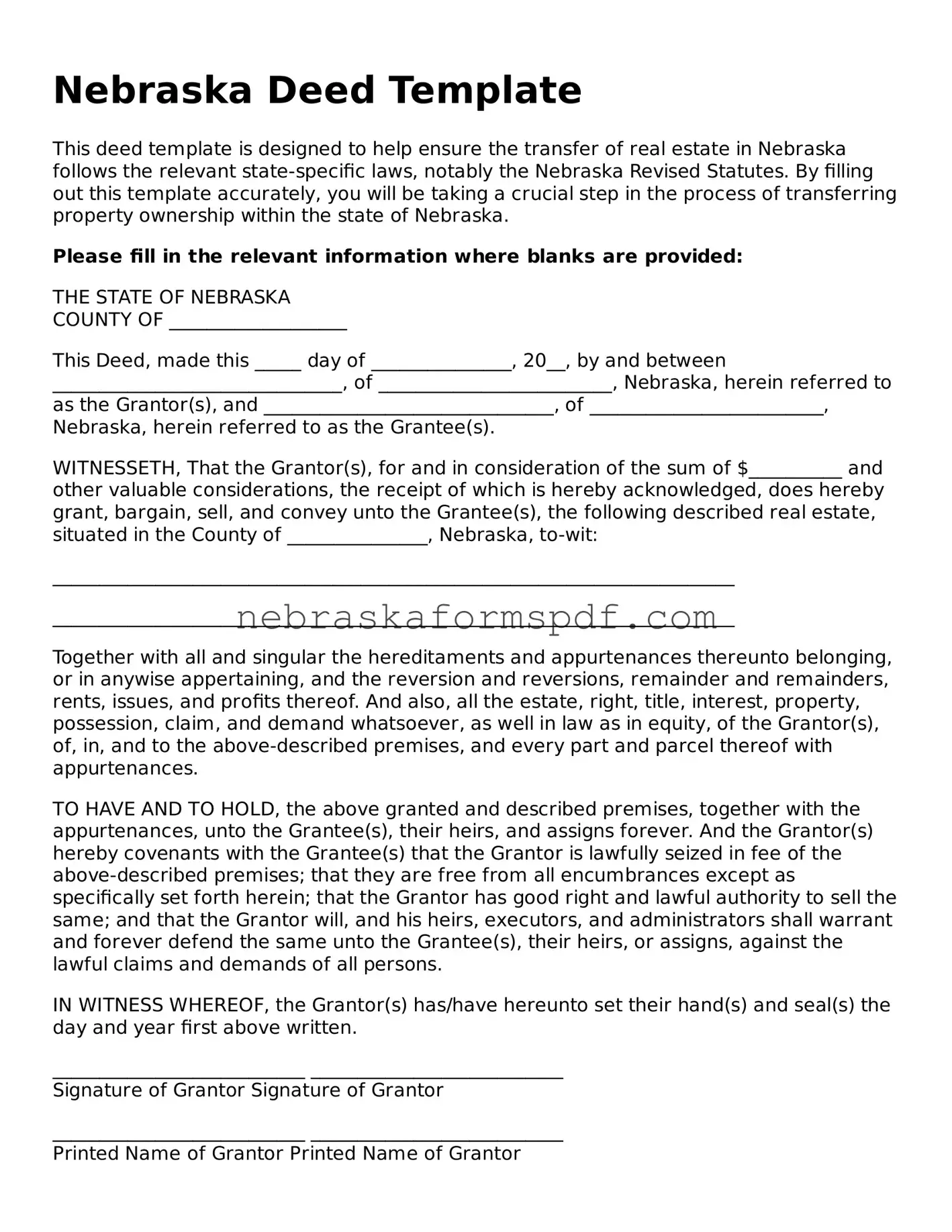

Nebraska Deed Template

This deed template is designed to help ensure the transfer of real estate in Nebraska follows the relevant state-specific laws, notably the Nebraska Revised Statutes. By filling out this template accurately, you will be taking a crucial step in the process of transferring property ownership within the state of Nebraska.

Please fill in the relevant information where blanks are provided:

THE STATE OF NEBRASKA

COUNTY OF ___________________

This Deed, made this _____ day of _______________, 20__, by and between _______________________________, of _________________________, Nebraska, herein referred to as the Grantor(s), and _______________________________, of _________________________, Nebraska, herein referred to as the Grantee(s).

WITNESSETH, That the Grantor(s), for and in consideration of the sum of $__________ and other valuable considerations, the receipt of which is hereby acknowledged, does hereby grant, bargain, sell, and convey unto the Grantee(s), the following described real estate, situated in the County of _______________, Nebraska, to-wit:

_________________________________________________________________________

_________________________________________________________________________

Together with all and singular the hereditaments and appurtenances thereunto belonging, or in anywise appertaining, and the reversion and reversions, remainder and remainders, rents, issues, and profits thereof. And also, all the estate, right, title, interest, property, possession, claim, and demand whatsoever, as well in law as in equity, of the Grantor(s), of, in, and to the above-described premises, and every part and parcel thereof with appurtenances.

TO HAVE AND TO HOLD, the above granted and described premises, together with the appurtenances, unto the Grantee(s), their heirs, and assigns forever. And the Grantor(s) hereby covenants with the Grantee(s) that the Grantor is lawfully seized in fee of the above-described premises; that they are free from all encumbrances except as specifically set forth herein; that the Grantor has good right and lawful authority to sell the same; and that the Grantor will, and his heirs, executors, and administrators shall warrant and forever defend the same unto the Grantee(s), their heirs, or assigns, against the lawful claims and demands of all persons.

IN WITNESS WHEREOF, the Grantor(s) has/have hereunto set their hand(s) and seal(s) the day and year first above written.

___________________________ ___________________________

Signature of Grantor Signature of Grantor

___________________________ ___________________________

Printed Name of Grantor Printed Name of Grantor

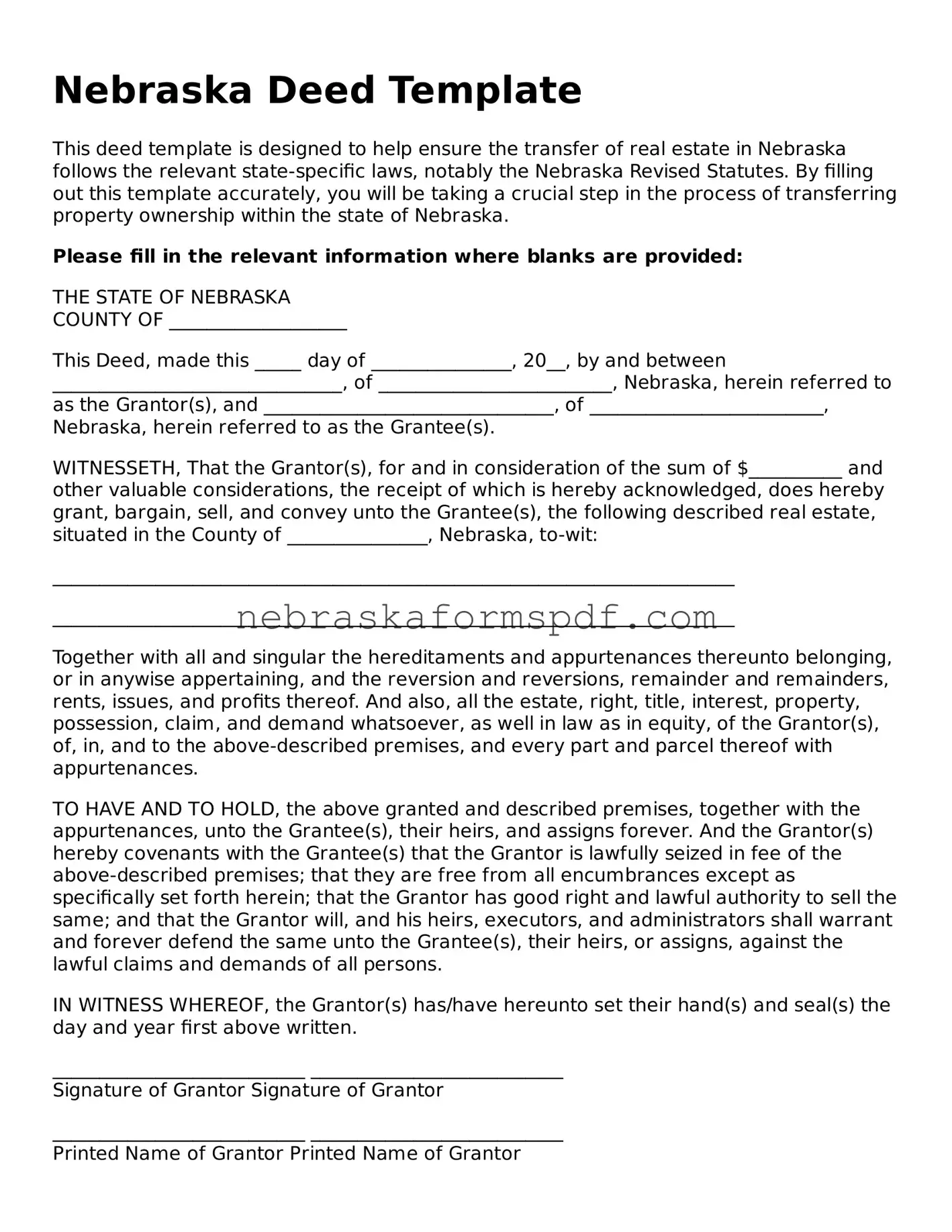

STATE OF NEBRASKA )

:SS

COUNTY OF ___________ )

On this _____ day of _______________, 20__, before me, the underserved notary public, personally appeared ____________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

IN WITNESS WHEREOF, I hereunto set my hand and official seal.

___________________________

Notary Public

My Commission Expires: ____________/p>