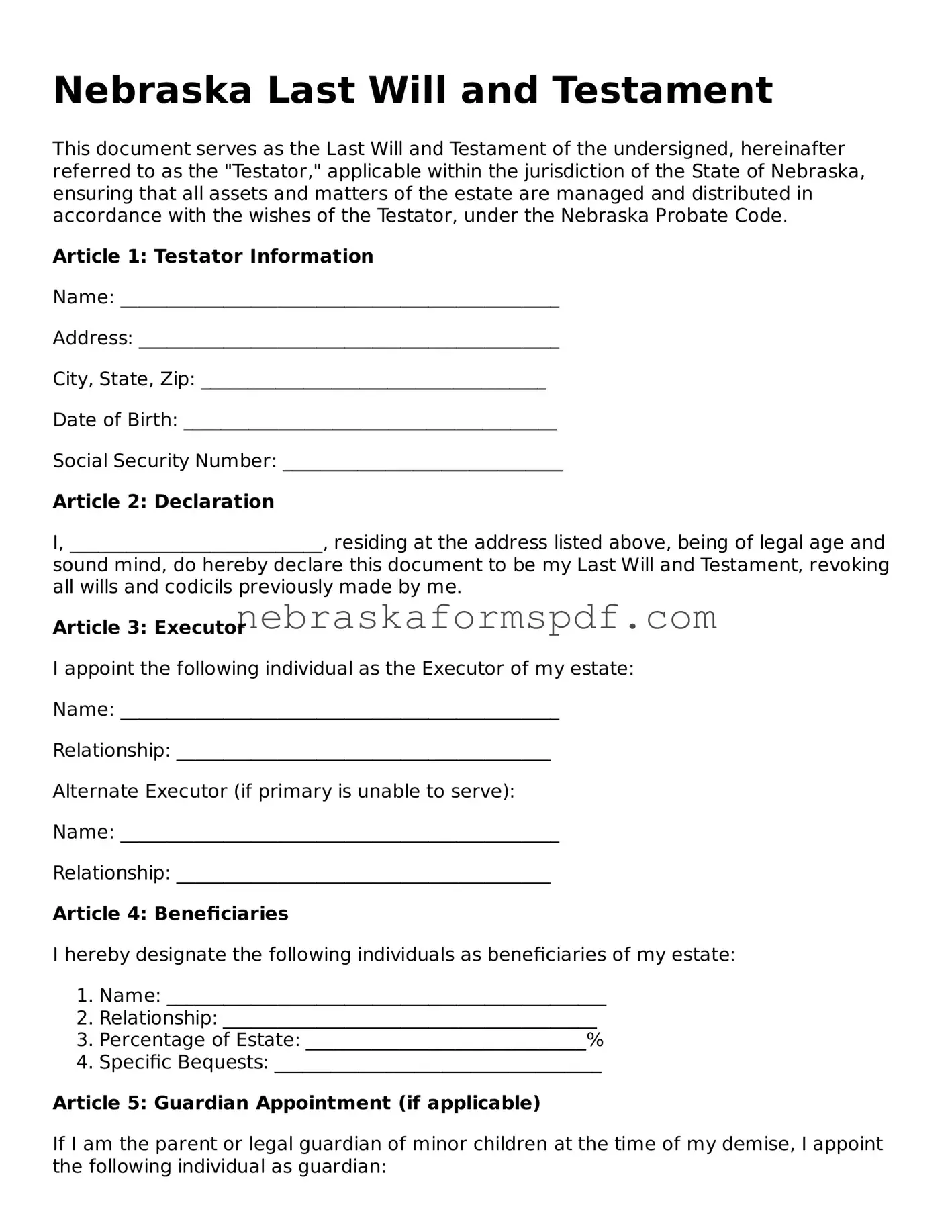

Nebraska Last Will and Testament

This document serves as the Last Will and Testament of the undersigned, hereinafter referred to as the "Testator," applicable within the jurisdiction of the State of Nebraska, ensuring that all assets and matters of the estate are managed and distributed in accordance with the wishes of the Testator, under the Nebraska Probate Code.

Article 1: Testator Information

Name: _______________________________________________

Address: _____________________________________________

City, State, Zip: _____________________________________

Date of Birth: ________________________________________

Social Security Number: ______________________________

Article 2: Declaration

I, ___________________________, residing at the address listed above, being of legal age and sound mind, do hereby declare this document to be my Last Will and Testament, revoking all wills and codicils previously made by me.

Article 3: Executor

I appoint the following individual as the Executor of my estate:

Name: _______________________________________________

Relationship: ________________________________________

Alternate Executor (if primary is unable to serve):

Name: _______________________________________________

Relationship: ________________________________________

Article 4: Beneficiaries

I hereby designate the following individuals as beneficiaries of my estate:

- Name: _______________________________________________

- Relationship: ________________________________________

- Percentage of Estate: ______________________________%

- Specific Bequests: ___________________________________

Article 5: Guardian Appointment (if applicable)

If I am the parent or legal guardian of minor children at the time of my demise, I appoint the following individual as guardian:

Name: _______________________________________________

Relationship: ________________________________________

Article 6: Signatures

This Last Will and Testament is executed on this date: _______________

Testator's Signature: _________________________________

Testator's Printed Name: ______________________________

Witnesses:

We, the undersigned, hereby certify that the above-named Testator, known to us, signed this Last Will and Testament in our presence as their voluntary act and deed, and that we, in turn, have signed as witnesses in the presence of the Testator and each other, this __________ day of _______________, 20__.

- Witness #1 Signature: _____________________________

- Printed Name: ____________________________________

- Address: __________________________________________

- Witness #2 Signature: _____________________________

- Printed Name: ____________________________________

- Address: __________________________________________