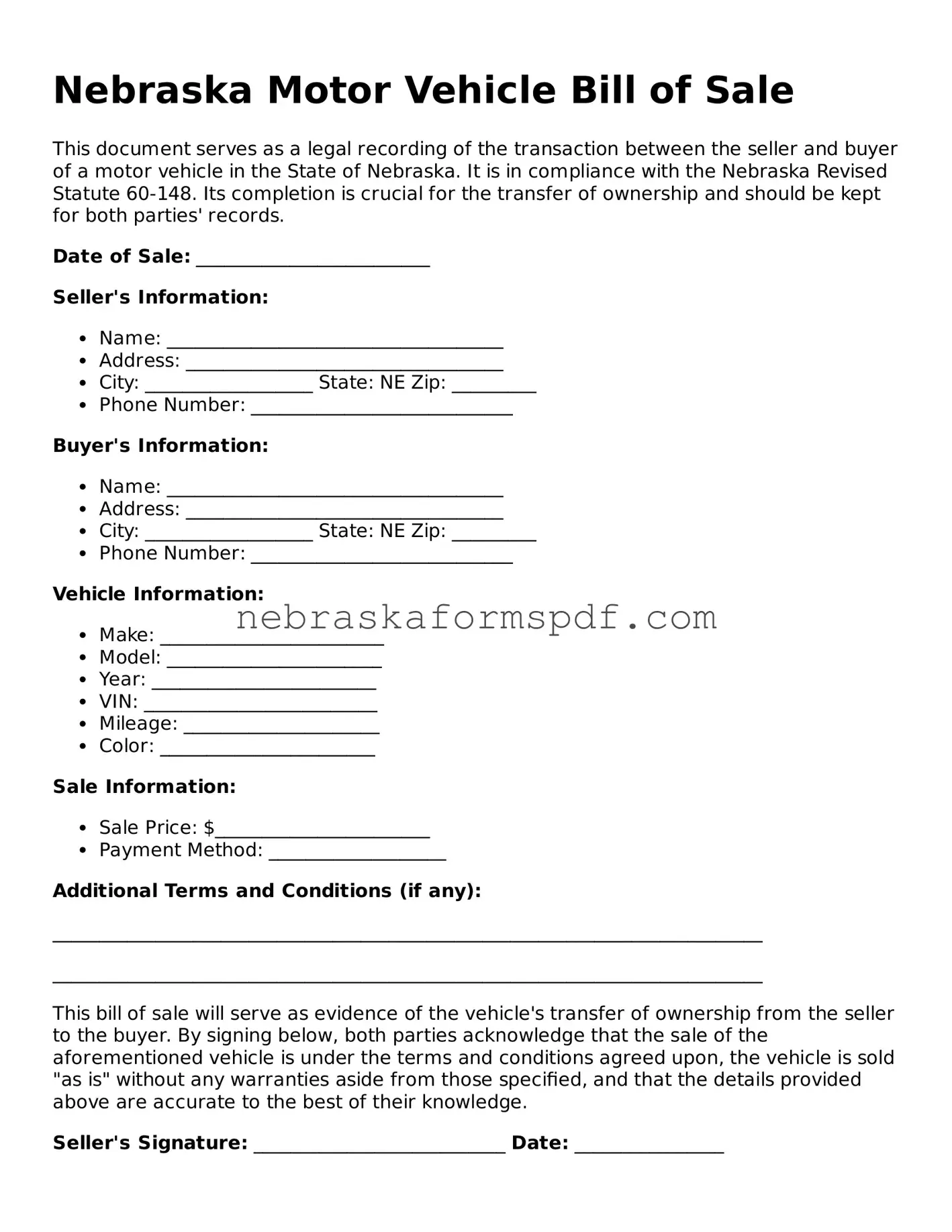

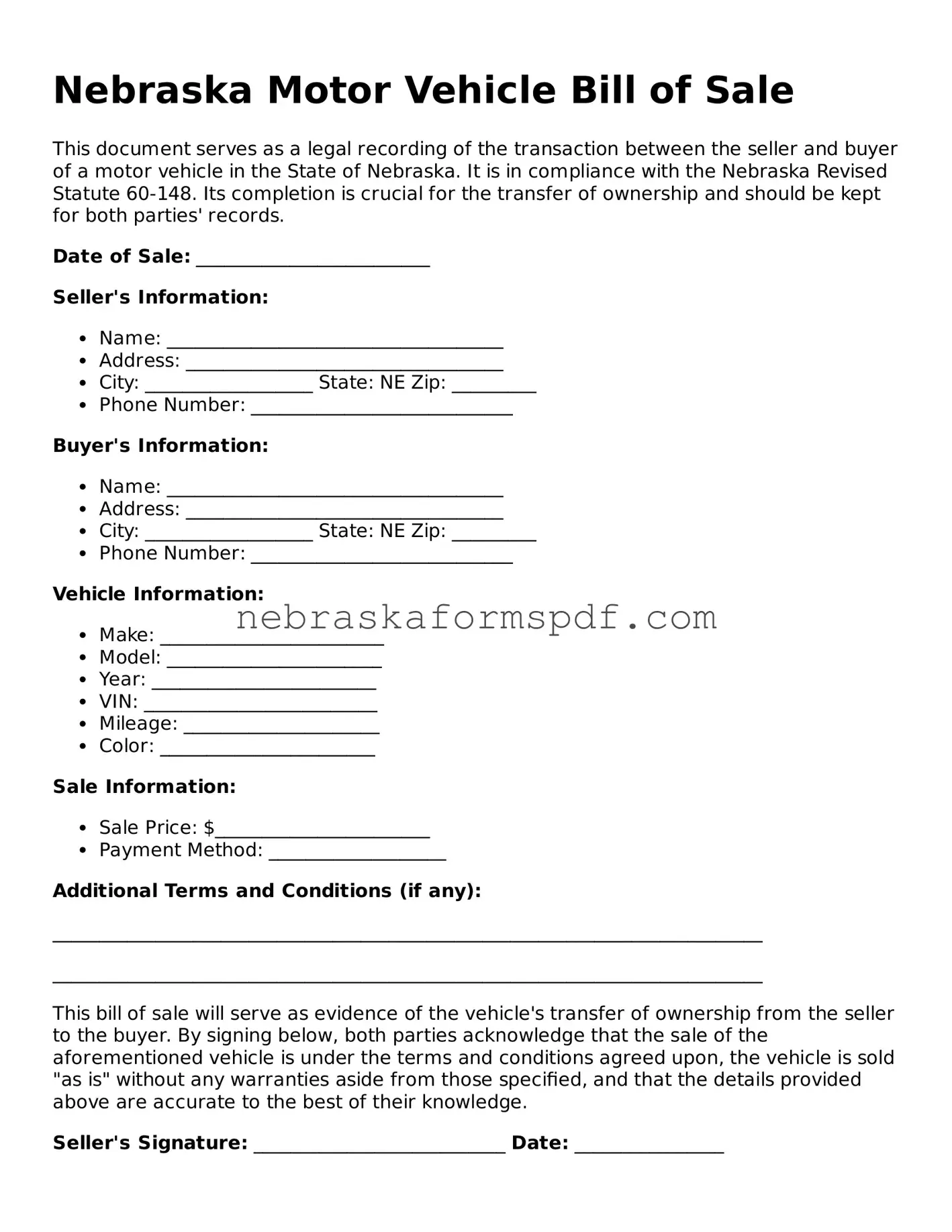

Fillable Nebraska Motor Vehicle Bill of Sale Template

A Nebraska Motor Vehicle Bill of Sale form is a crucial document used in the process of buying or selling a vehicle in the state. It serves as a legal record, confirming the transfer of ownership from the seller to the buyer. Not only does it provide proof of the transaction, but it also includes essential details about the vehicle and the transaction itself.

Open Editor Here

Fillable Nebraska Motor Vehicle Bill of Sale Template

Open Editor Here

Open Editor Here

or

Click for PDF Form

Don’t exit with an incomplete form

Finish Motor Vehicle Bill of Sale online using a quick, guided process.