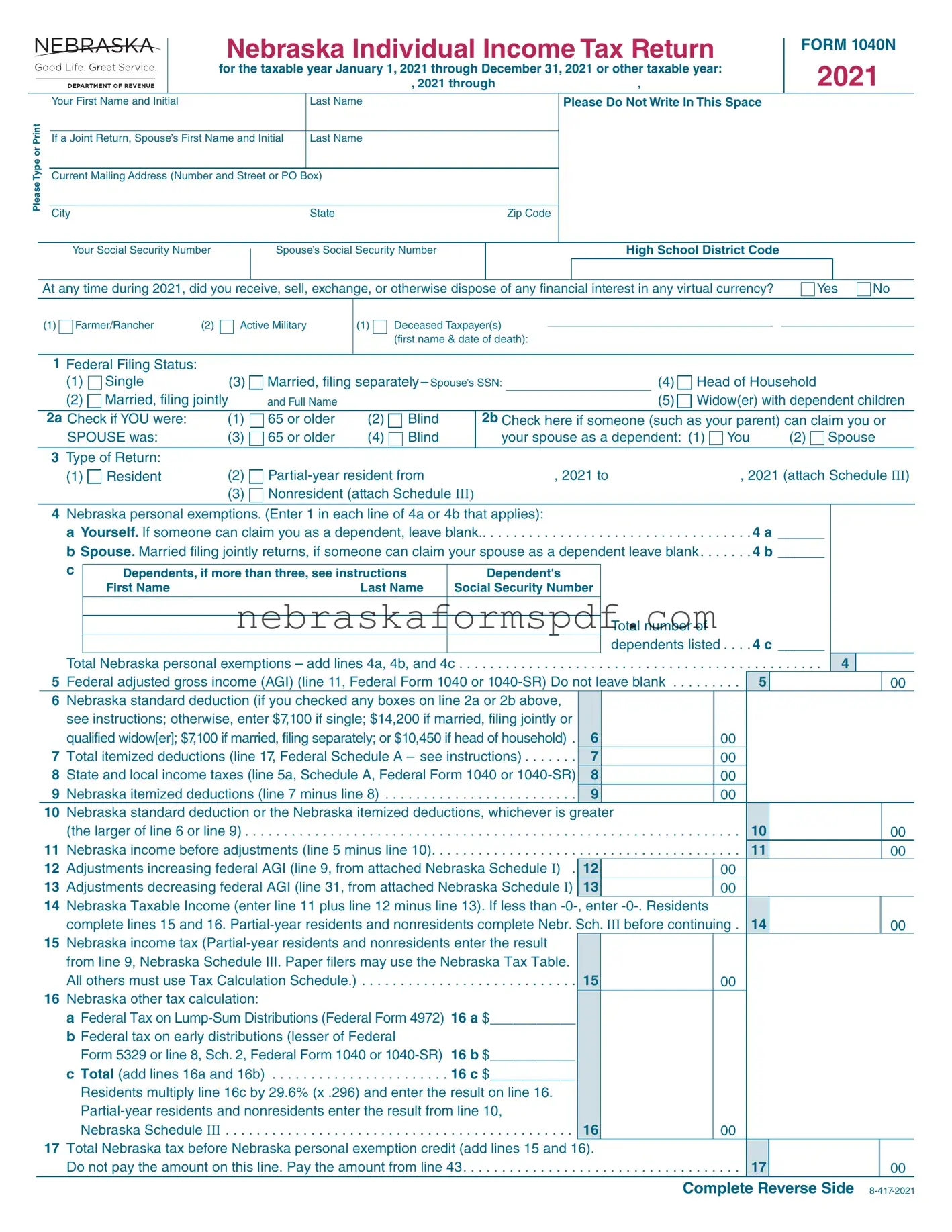

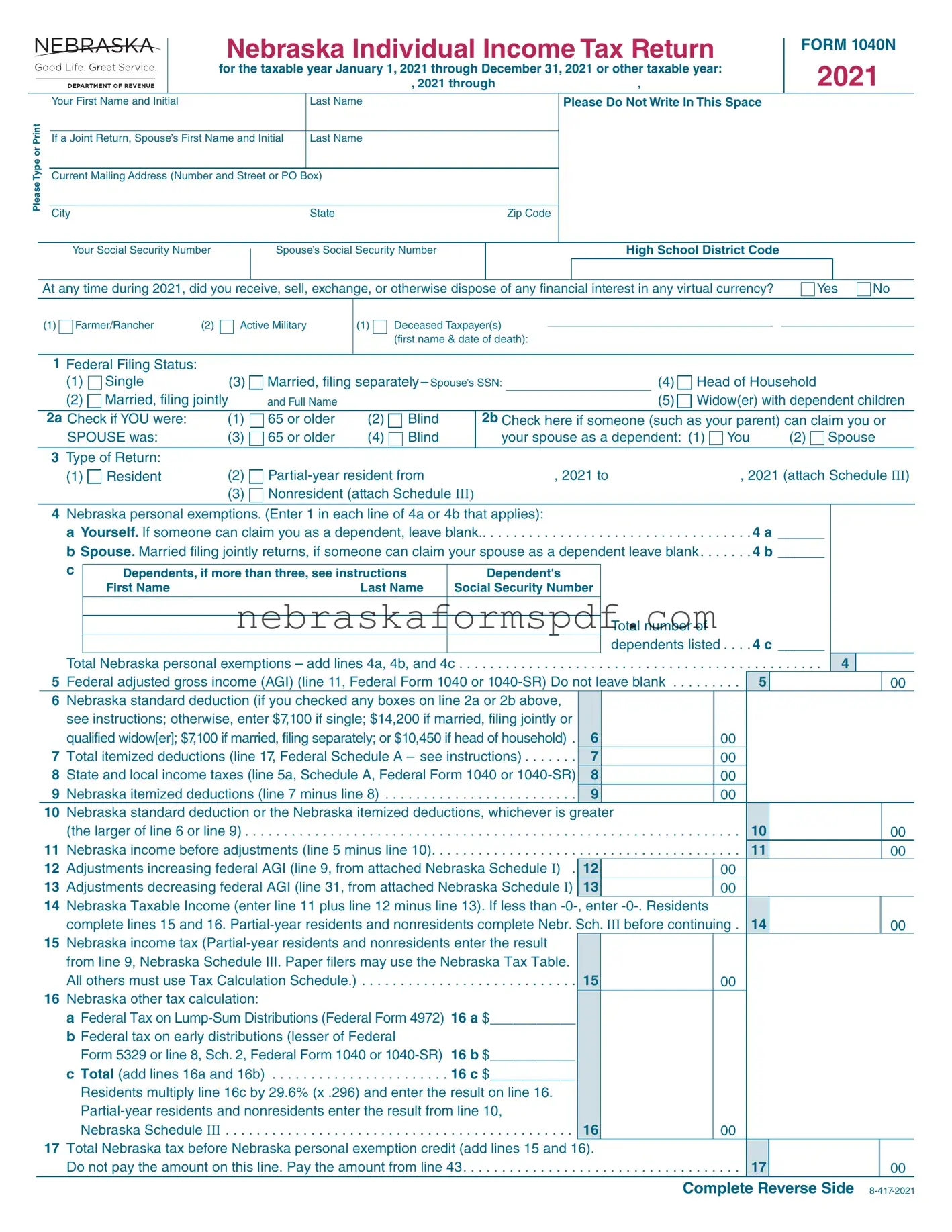

Fill a Valid Nebraska 1040N Form

The Nebraska 1040N form is the document used for state residents to file their annual income tax for the taxable year, covering periods from January 1, 2022, through December 31, 2022, or other specified taxable years. It outlines the process for detailing personal information, income, deductions, and any applicable credits. This form plays a crucial role in ensuring taxpayers correctly report their financial obligations to the state.

Open Editor Here

Fill a Valid Nebraska 1040N Form

Open Editor Here

Open Editor Here

or

Click for PDF Form

Don’t exit with an incomplete form

Finish Nebraska 1040N online using a quick, guided process.

. . . . . . . .

. . . . . . . .  use only

use only