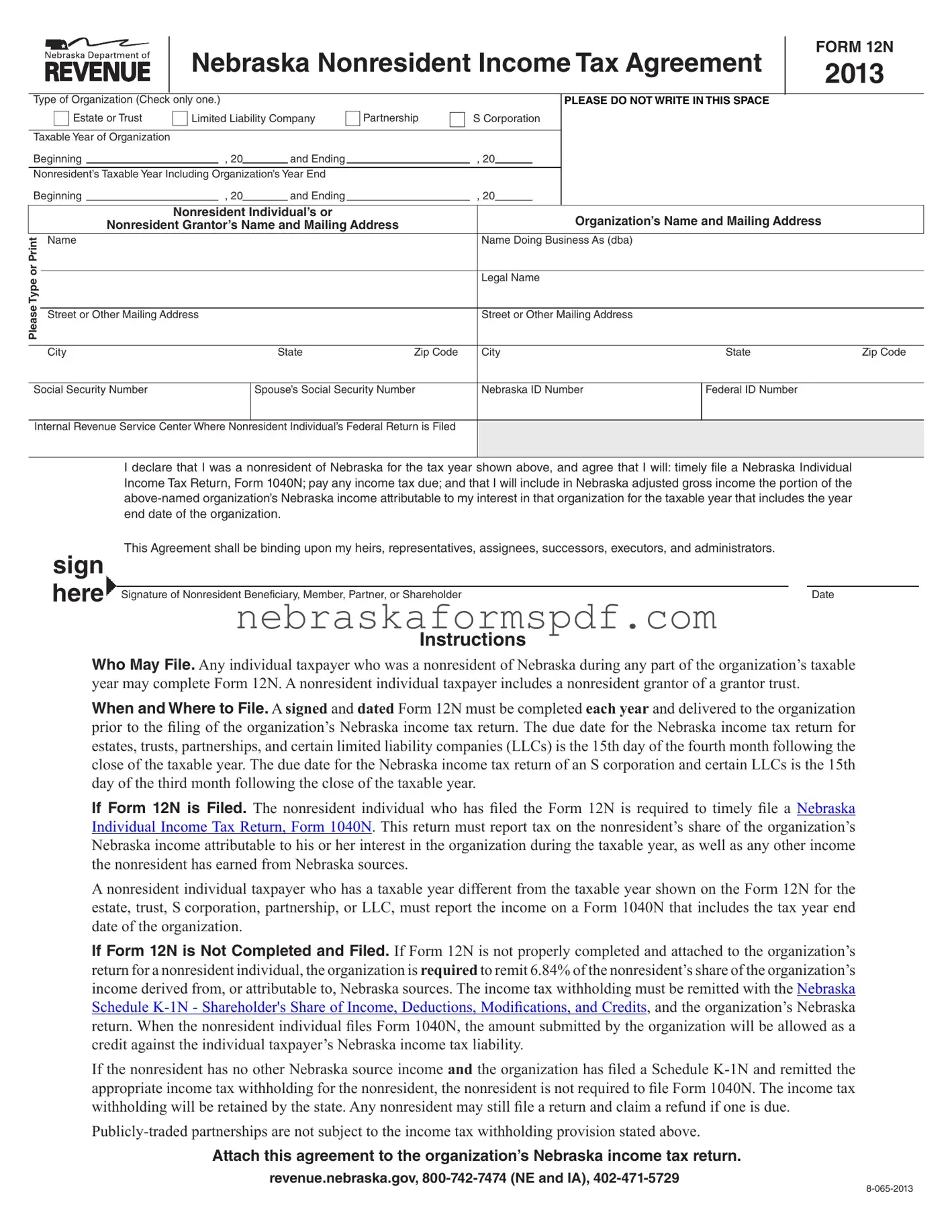

Fill a Valid Nebraska 12N Form

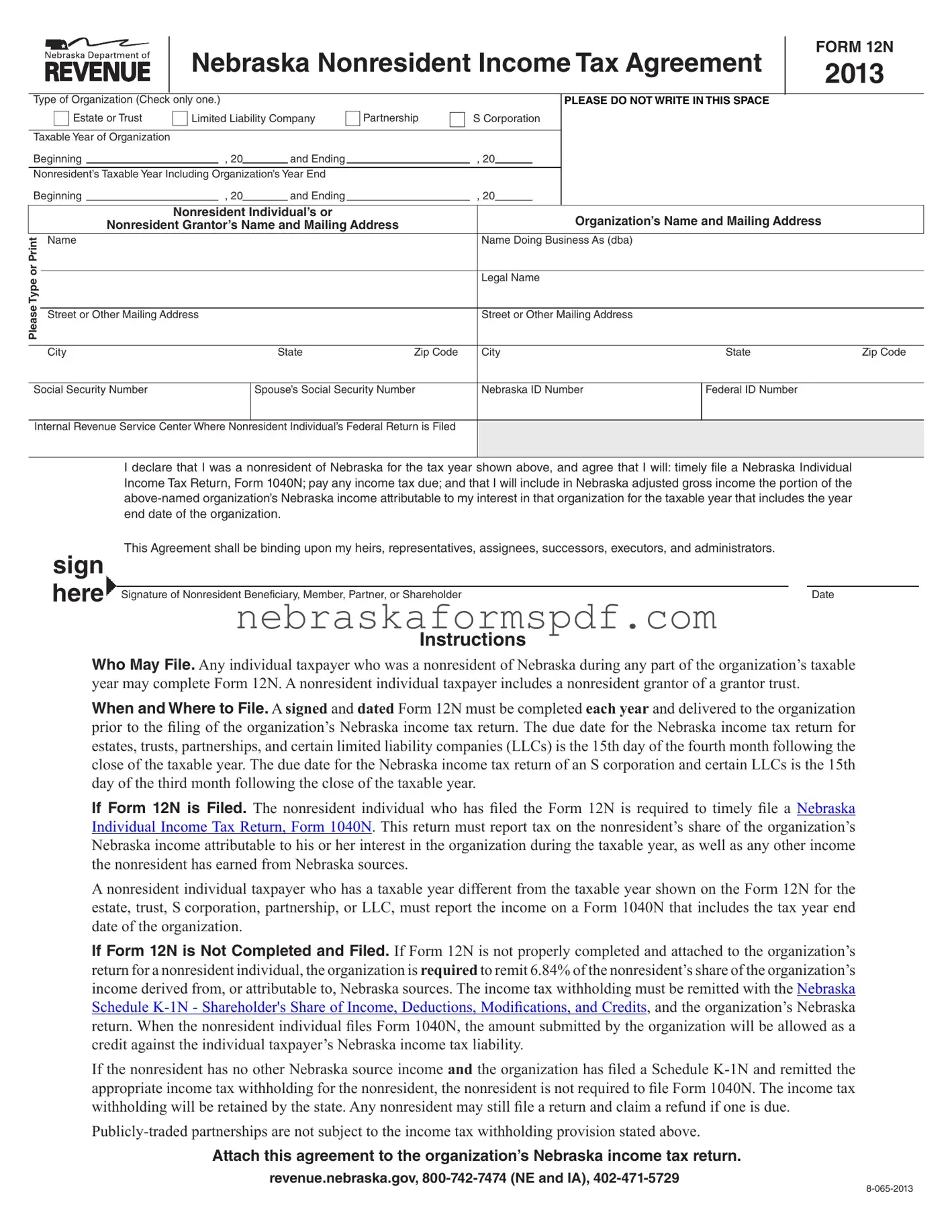

The Nebraska 12N form, known as the Nebraska Nonresident Income Tax Agreement, is a vital document for any nonresident individual who earns income through certain types of organizations within Nebraska. Designed for nonresidents involved with estates, trusts, limited liability companies, partnerships, and S corporations, this form helps individuals comply with Nebraska's state income tax requirements. By filling out the form, nonresidents agree to report their share of the organization's income on their tax returns and pay any due taxes, ensuring they meet legal obligations without complications.

Open Editor Here

Fill a Valid Nebraska 12N Form

Open Editor Here

Open Editor Here

or

Click for PDF Form

Don’t exit with an incomplete form

Finish Nebraska 12N online using a quick, guided process.