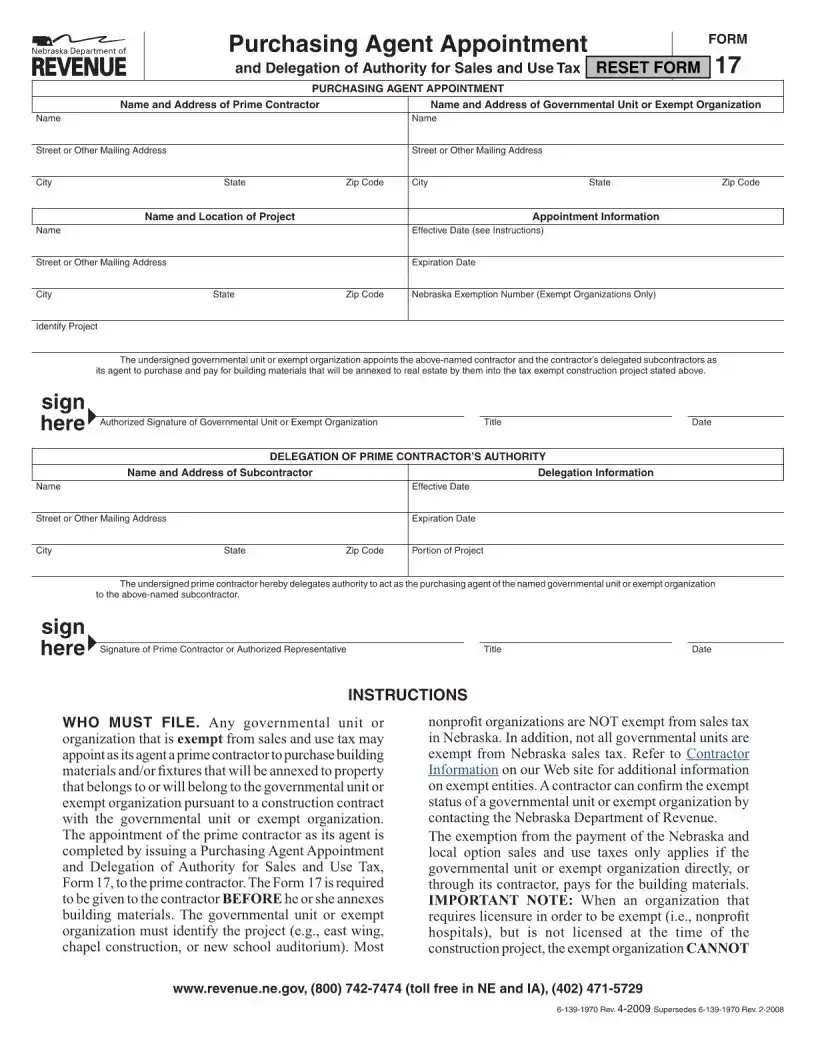

The Nebraska 17 form, officially known as the Application for Certificate of Title for a Motor Vehicle, is a crucial document used in the state of Nebraska. It serves the purpose of registering a motor vehicle and is required for establishing legal ownership. This form is used when one is buying, inheriting, or in any manner acquiring a motor or towed vehicle.

Anyone who is acquiring a vehicle in the state of Nebraska, whether through purchase, inheritance, gift, or any other means, must fill out this form. It is also necessary for those who are registering a vehicle in Nebraska for the first time. This includes new residents moving to Nebraska with a vehicle that needs to be registered locally.

There seems to be a slight misunderstanding in the question, as the focus here is supposed to be on the Nebraska 17 form. Assuming the question intended to inquire about the submission timeline of the Nebraska 17 form, it's important to note that this form should be submitted shortly after acquiring a vehicle or deciding to register the vehicle in Nebraska. Nebraska law requires new owners to apply for a new title within 30 days of acquisition to avoid penalties.

The Nebraska 17 form can be obtained from several sources for convenience. It is available online on the Nebraska Department of Motor Vehicles (DMV) website, where it can be downloaded and printed. Alternatively, one can visit a local DMV office or a county treasurer's office to pick up a copy of the form in person.

To complete the application process with the Nebraska 17 form, several additional documents are required, including:

-

A valid form of identification, such as a driver's license.

-

Proof of insurance for the vehicle.

-

The vehicle's previous title or Manufacturer's Certificate of Origin (MCO).

-

A bill of sale or other proof of ownership transfer.

-

If applicable, a lien release.

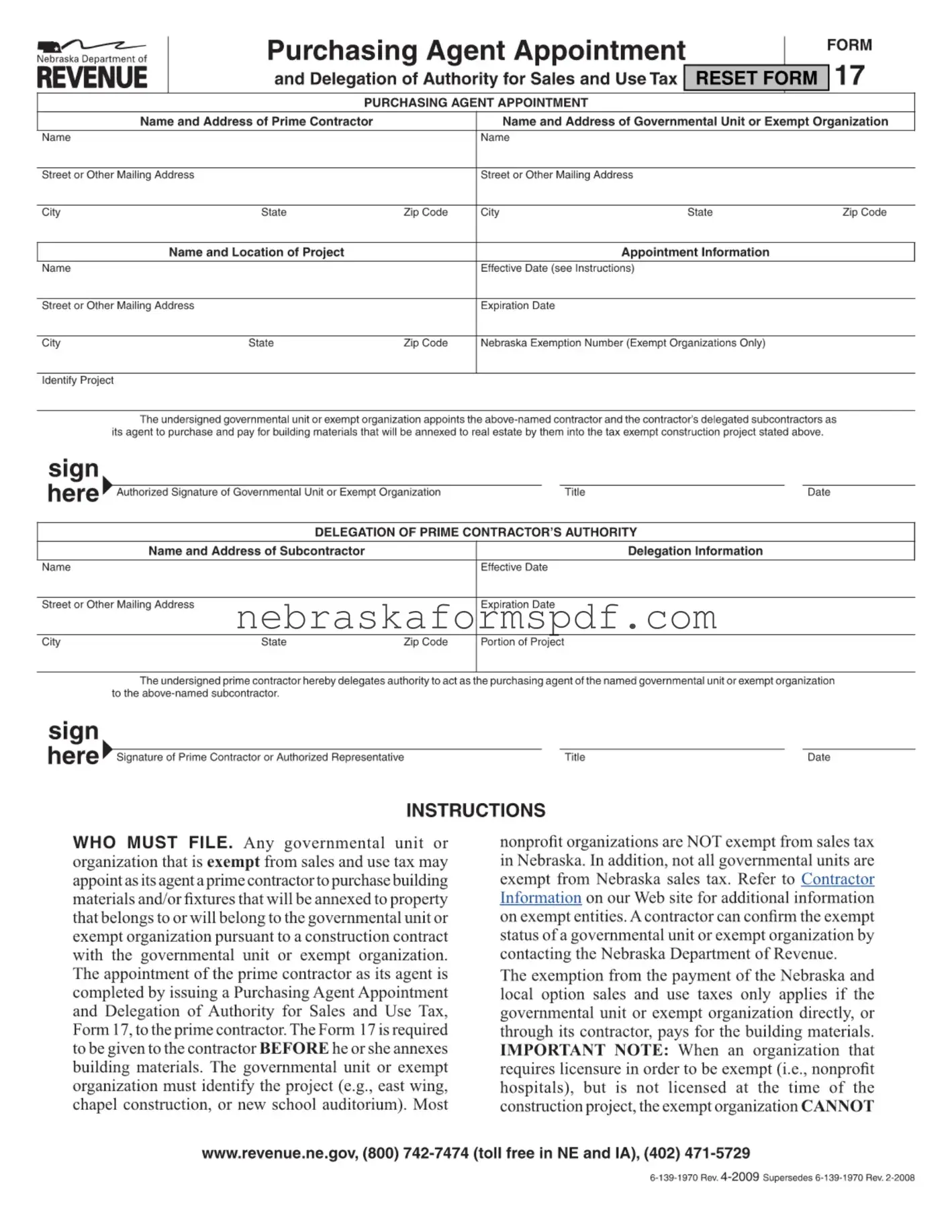

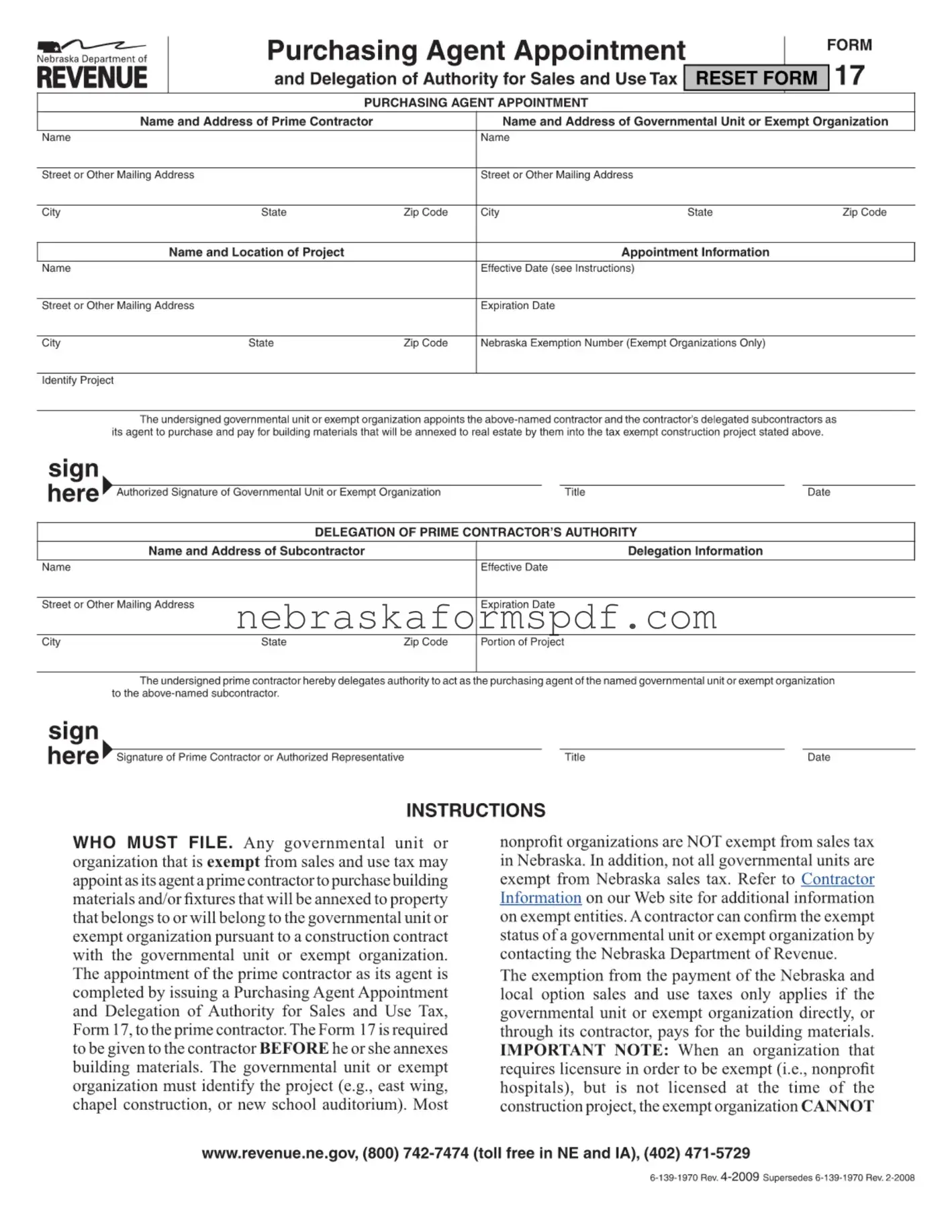

Completing the Nebraska 17 form involves filling out several sections accurately. Key information that must be provided includes the vehicle identification number (VIN), make, model, and year of the vehicle, the name and address of the buyer and seller, and any lienholder information if applicable. Detailed instructions are provided on the form to guide applicants through each section to ensure the form is filled out correctly.

As of the last update, the Nebraska 17 form cannot be submitted electronically. Applicants must submit the completed form in person at a DMV office or mail it to the county treasurer's office where the vehicle will be registered. This ensures that all necessary original documents can be reviewed and verified by the appropriate authorities.

After the Nebraska 17 form is submitted along with all required documentation, the county treasurer's office will process the application. This includes verifying the information, collecting any applicable taxes and fees, and issuing a new title in the applicant's name. If everything is in order, the applicant will receive a new title, usually within several weeks. It's important to keep a receipt or other proof of submission until the new title is received.