7-104-1975 Rev. 9-2021 Supersedes 7-104-1975 Rev. 2-2021

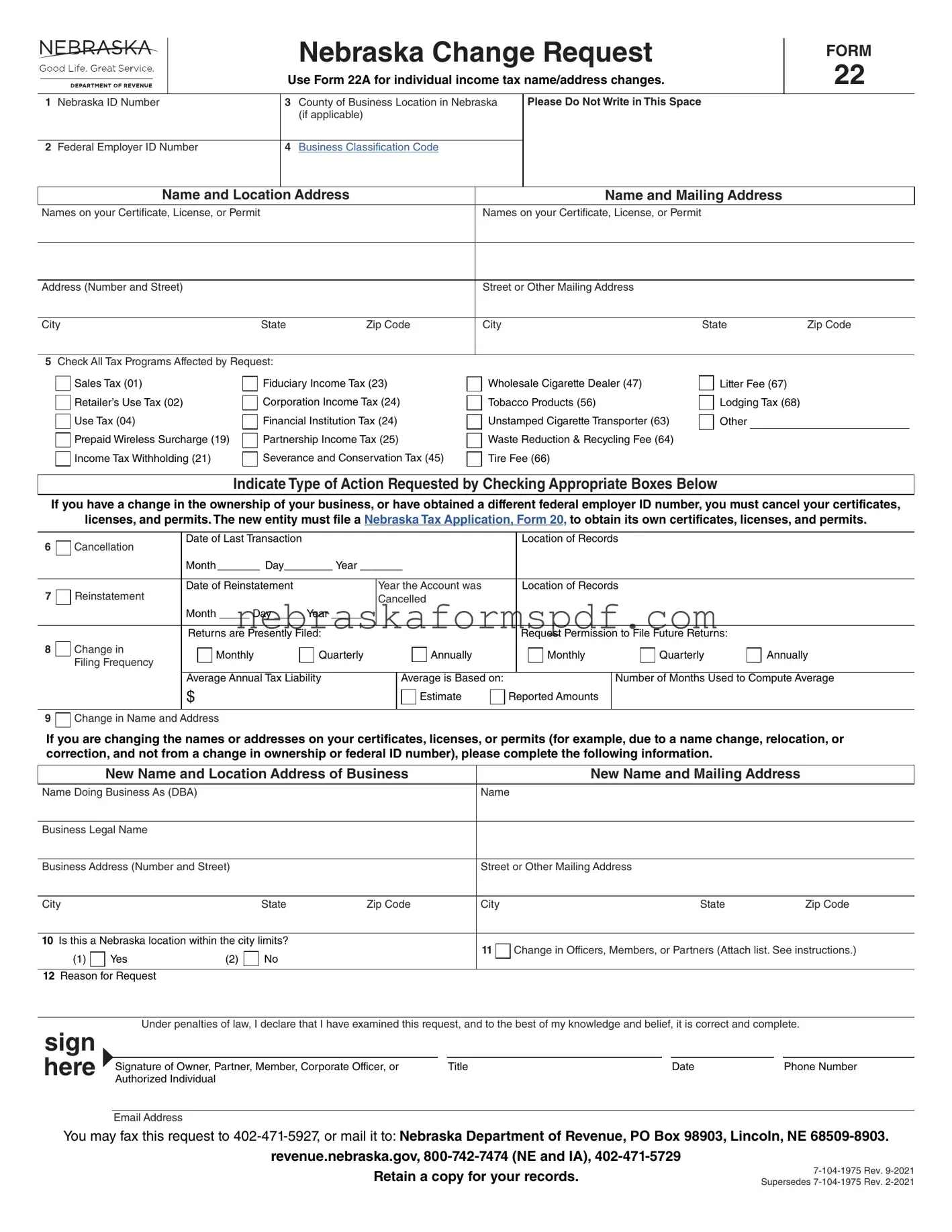

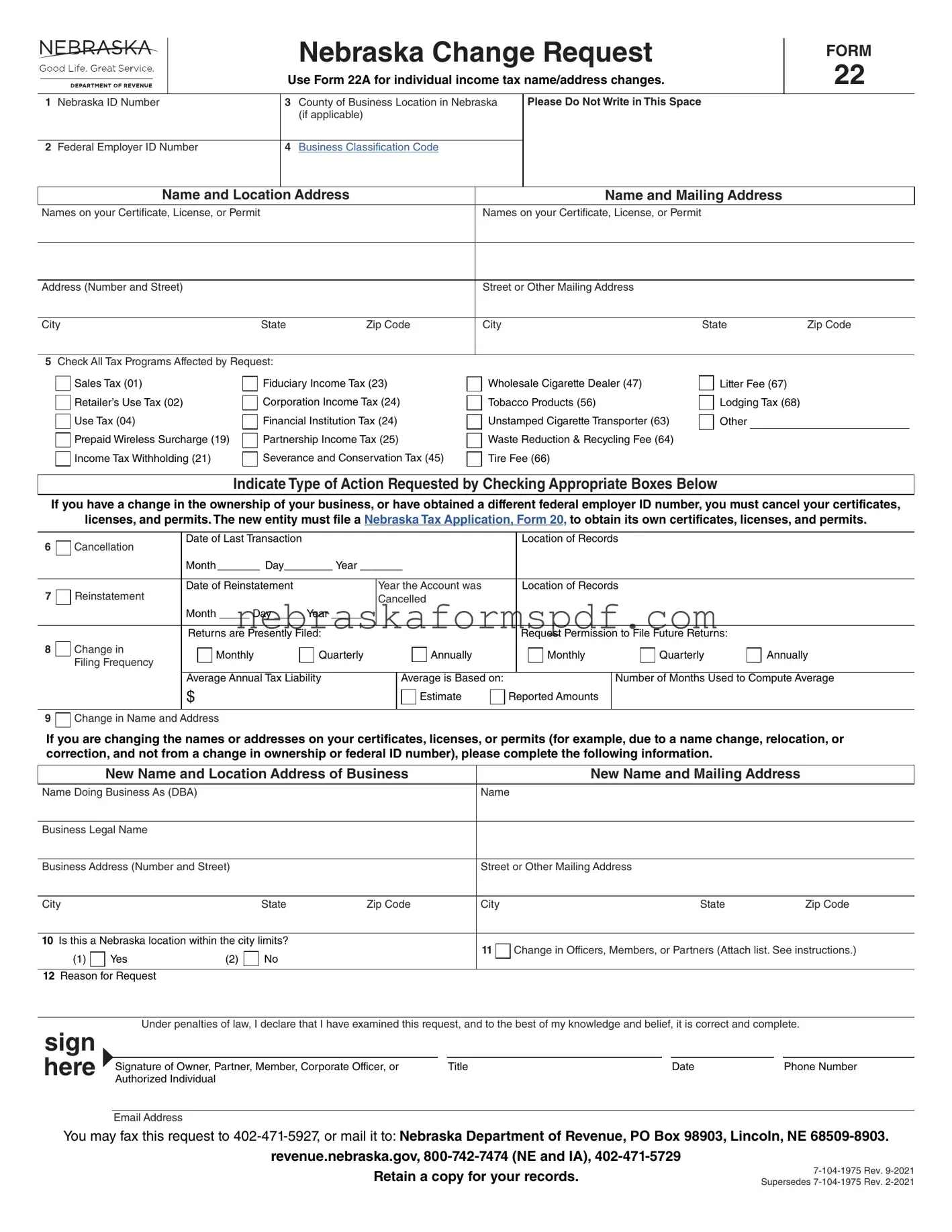

Nebraska Change Request

Use Form 22A for individual income tax name/address changes.

3County of Business Location in Nebraska (if applicable)

Please Do Not Write in This Space

2Federal Employer ID Number

4Business Classification Code

Name and Location Address |

Name and Mailing Address |

Names on your Certificate, License, or Permit |

Names on your Certificate, License, or Permit |

Address (Number and Street)

Street or Other Mailing Address

5Check All Tax Programs Affected by Request:

Sales Tax (01)

Retailer’s Use Tax (02)

Use Tax (04)

Prepaid Wireless Surcharge (19) Income Tax Withholding (21)

Fiduciary Income Tax (23)

Corporation Income Tax (24)

Financial Institution Tax (24)

Partnership Income Tax (25)

Severance and Conservation Tax (45)

Wholesale Cigarette Dealer (47) Tobacco Products (56)

Unstamped Cigarette Transporter (63)

Waste Reduction & Recycling Fee (64)

Tire Fee (66)

Litter Fee (67)

Lodging Tax (68)

Other

Indicate Type of Action Requested by Checking Appropriate Boxes Below

If you have a change in the ownership of your business, or have obtained a different federal employer ID number, you must cancel your certificates,

licenses, and permits. The new entity must file a Nebraska Tax Application, Form 20, to obtain its own certificates, licenses, and permits.

6 |

Cancellation |

Date of Last Transaction |

|

|

|

|

|

|

Location of Records |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month _______ Day________ Year _______ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reinstatement |

Date of Reinstatement |

|

Year the Account was |

|

Location of Records |

|

|

7 |

|

|

Cancelled |

|

|

|

|

|

|

|

Month _____ Day _____ Year _____ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Returns are Presently Filed: |

|

|

|

|

|

Request Permission to File Future Returns: |

|

8 |

Change in |

Monthly |

Quarterly |

|

|

|

Annually |

|

Monthly |

Quarterly |

Annually |

|

|

|

|

|

Filing Frequency |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Annual Tax Liability |

|

Average is Based on: |

|

|

Number of Months Used to Compute Average |

|

|

$ |

|

|

|

Estimate |

Reported Amounts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in Name and Address

If you are changing the names or addresses on your certificates, licenses, or permits (for example, due to a name change, relocation, or correction, and not from a change in ownership or federal ID number), please complete the following information.

New Name and Location Address of Business |

|

New Name and Mailing Address |

|

|

|

|

|

|

|

Name Doing Business As (DBA) |

|

|

Name |

|

|

|

|

|

|

|

|

Business Legal Name |

|

|

|

|

|

|

|

|

|

|

Business Address (Number and Street) |

|

|

Street or Other Mailing Address |

|

|

|

|

|

|

|

City |

State |

Zip Code |

City |

State |

Zip Code |

10Is this a Nebraska location within the city limits?

|

|

|

11 |

|

Change in Officers, Members, or Partners (Attach list. See instructions.) |

(1) |

Yes |

(2) |

No |

|

|

|

|

12Reason for Request

Under penalties of law, I declare that I have examined this request, and to the best of my knowledge and belief, it is correct and complete.

Signature of Owner, Partner, Member, Corporate Officer, or |

Title |

Date |

Phone Number |

Authorized Individual |

|

|

|

|

|

|

|

Email Address |

|

|

|

You may fax this request to 402-471-5927, or mail it to: Nebraska Department of Revenue, PO Box 98903, Lincoln, NE 68509-8903.

revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729

Retain a copy for your records.

Instructions

Who Must File. A Form 22 should be filed by any taxpayer who:

•Has a name or address change;

•Needs to correct, cancel, reinstate, or change a Nebraska tax certificate, license, or permit;

•Needs to change the filing frequency for sales and use tax, tire fee, lodging tax, or income tax withholding returns; or

•Needs to report a change in officers, members, or partners of the business or organization.

One request may be used to correct, cancel, or change more than one certificate, license, or permit held by the taxpayer for the tax programs listed, provided the Nebraska ID number is the same. Nebraska Change of Address Request for Individual Income Tax Only, Form 22A, should be used for individual income tax name and address changes.

When and Where to File. Mail to the Nebraska Department of Revenue, PO Box 98903, Lincoln, NE 68509-8903, or fax to 402-471-5927, prior to the change.

Permanently Closing the Business. Form 22 should be filed to cancel one or more of the tax programs listed in line 5. You are required to file all tax returns for tax periods through the date of your last transaction, or the last wage payment made. This date is entered on line 6.

Employers who cancel their income tax withholding account should, within 30 days after discontinuing business, file a final Nebraska Reconciliation of Income Tax Withheld, Form W-3N, and attach the state copy of each Wage and Tax Statement, Federal Form W-2, issued to each employee.

Specific Instructions

Line 1. Enter the Nebraska ID number that you hold or have previously held. Do not enter your Social Security number.

Line 2. Enter your federal employer ID number, if you hold one. If one has been applied for, enter “Applied For.” If no federal employer ID number is held or applied for, enter your Social Security number.

Line 3. Enter the Nebraska county where your business is located. If located outside of Nebraska, enter “none”. See line 9 instructions if you are changing your location address.

Name and Address. Enter the name and address as last filed with the Nebraska Department of Revenue (DOR) or which is printed on your present certificate, license, or permit. If you are changing the name or address, the new name or address should be entered in the area immediately following line 9 of this request.

Line 5. Check the tax programs affected by this request. If there is a change in more than one program, check all appropriate boxes.

Line 6. A taxpayer closing a business must request cancellation of the tax program. A taxpayer having a seasonal type of business may request cancellation of the tax program for the period in which no business activity is conducted. Returns must be filed for all periods ending prior to the date of cancellation.

A change in ownership or type of ownership will require a new certificate, license, or permit. When possible, the Nebraska Tax Application, Form 20, used to obtain a new certificate, license, or permit, should accompany or precede this request for cancellation.

Line 7. A taxpayer who previously cancelled a tax program may have it reinstated provided no change in the business has occurred that would require a new certificate, license, or permit.

Line 8. A taxpayer filing a sales tax, use tax, or tire fee return with a tax liability of $900 to $3,000 annually may request a quarterly filing frequency. Those with a tax liability of less than $900 annually may request an annual filing frequency. Taxpayers filing a lodging tax return and remitting $99 or less of tax annually may request to file an annual return. Employers withholding less than $500 annually in state income tax may request to file an annual return, rather than quarterly returns.

Changes in filing frequency are not effective until the taxpayer receives approval from DOR. The taxpayer must complete and file all preidentified returns received for periods prior to the approval.

Line 9. Enter the new name and address. If your new location address is in a different county, enter the county in line 3 for your new location. The location address box cannot contain a PO Box Number; it must show the street address. If the taxpayer wants a return to be mailed to a preparer or another person, the name and mailing address should be completed to show this change.

Line 11. In order to keep your information current, please provide information on changes in officers, members, or partners, of your business or organization. Attach a complete list with the name, street address, email address, title, and Social Security number. Also, identify those that need to be removed and the effective date of the changes.

Line 12. Please provide a detailed explanation of the reason for this request. If there has been a change in ownership, give the name and address of the new owner.

Signature. This request must be signed by the owner, partner, member, corporate officer, or other individual authorized to sign by a power of attorney on file with DOR.

Email. By entering an email address, the taxpayer acknowledges that DOR may contact the taxpayer by email. The taxpayer accepts any risk to confidentiality associated with this method of communication. DOR will send all confidential information by secure email or by the State of Nebraska file share system. If you do not wish to be contacted by email, write “Opt Out” on the line labeled “email address.”