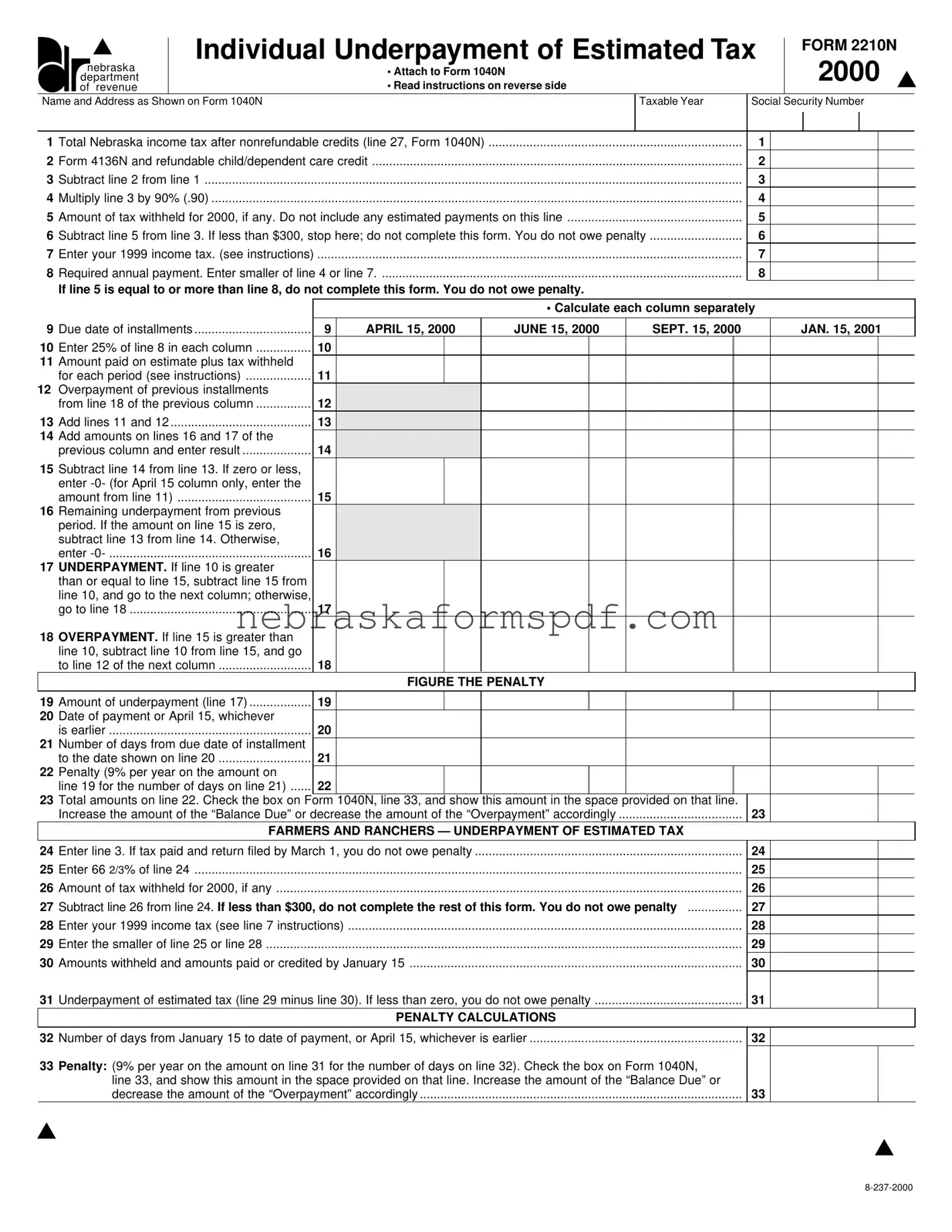

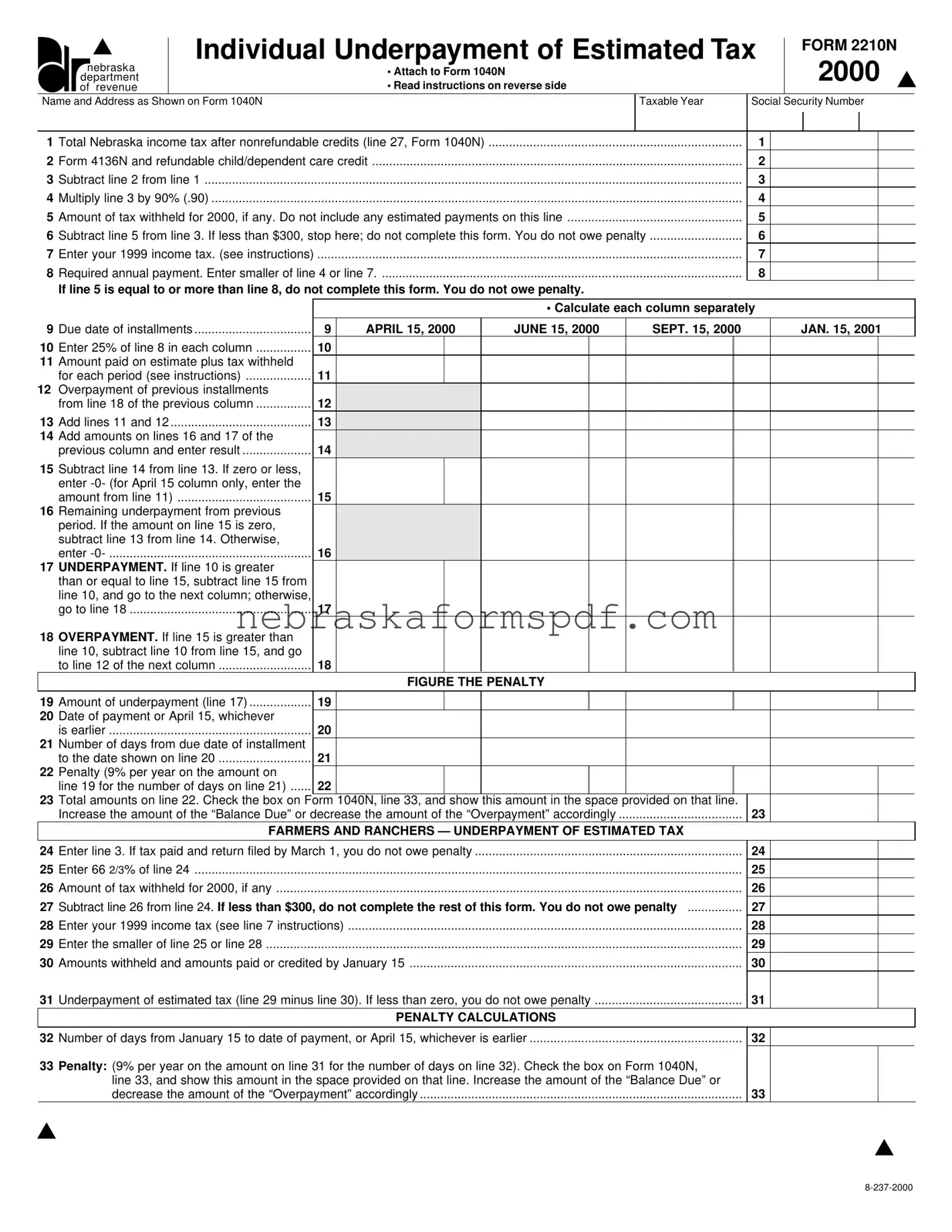

WHO MUST FILE. Individuals who determine on line 17 of this form that their Nebraska individual income tax was not sufficiently paid at any time throughout the year must file Individual Underpayment of Estimated Tax, Form 2210N, to calculate the amount of penalty due.

WHO MUST PAY THE UNDERPAYMENT PENALTY. An individual who did not pay enough estimated tax by any of the due dates or who did not have enough state income tax withheld may be charged a penalty. This is true even if you are due a refund when you file your tax return. The penalty is figured separately for each due date. Therefore, you may owe the penalty for an earlier payment due, even if you paid enough tax later to make up the underpayment.

In general, you may owe the penalty for 2000 if you did not pay at least the smaller of:

1.90% of your 2000 tax liability; or

2.100% of your 1999 tax liability (if you filed a 1999 return that covered a full 12 months).

EXCEPTIONS TO THE PENALTY. You will not have to pay the penalty if either 1 or 2 applies:

1.You had no tax liability for 1999 , you were a U.S. citizen or resident for the entire year, and your 1999 Nebraska tax return was (or would have been had you been required to file) for a full 12 months.

2.The total tax shown on your 2000 return minus the amount of tax you paid through withholding is less than $300. To determine whether the total tax is less than $300, complete lines 1-6.

Nebraska Tax on Annualized Income. No penalty will be imposed if your Nebraska tax payments equal or exceed 90% of the Nebraska tax for a Nebraska tax liability based on annualized income earned through the end of the month preceding the installment date. Attach a separate schedule showing your computation similar to the federal Annualized Income Installment Method Schedule.

Other Circumstances. Attach a statement to this form outlining why the penalty should not be imposed. This would include an underpayment due to casualty, disaster, or other unusual circumstance where it would be inequitable to impose the penalty. Penalty may also be waived if in 1999 or 2000, you retired after age 62 or became disabled, and your underpayment was due to reasonable cause. Attach a statement if this circumstance applies to you.

WHEN AND WHERE TO FILE. Form 2210N must be attached and filed with the Nebraska Individual Income Tax Return, Form 1040N.

SPECIFIC LINE INSTRUCTIONS

LINE 7, 1999 TAX. Use your 1999 tax after nonrefundable credits from your 1999 tax return. If the 1999 tax year was for less than 12 months, do not complete this line. Instead, enter the amount from line 4 on line 8 and complete the remainder

of the form. If federal adjusted gross income in 1999 was more than $150,000 ($75,000 – married separate), enter 108.6% of your 1999 taxes on line 7.

LINE 9, INSTALLMENT PAYMENTS. If you filed your Nebraska income tax return and paid the balance of the tax due by January 31, that balance is considered paid as of January 15.

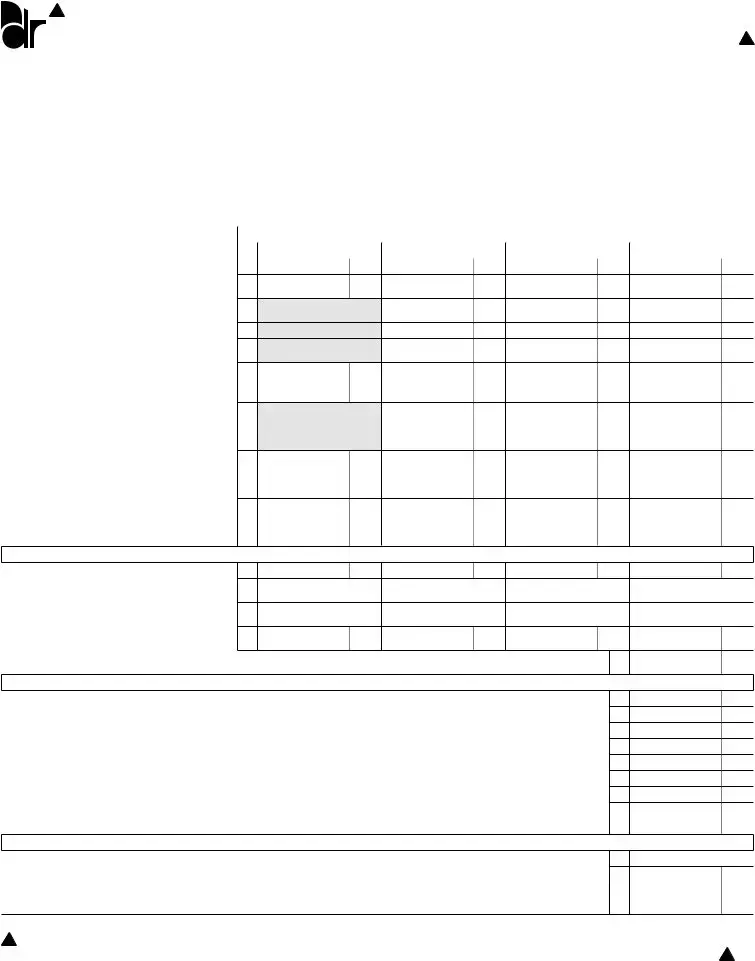

Fiscal Year Taxpayers. The installment due dates for fiscal year taxpayers are the 15th day of the following months: the first month of the second quarter, the third month of the second quarter, the third month of the third quarter, and the first month of the following fiscal year. All dates on Form 2210N are to be considered in the corresponding month of the fiscal year.

LINE 11, TAX WITHHELD. An equal part of the Nebraska income tax withheld during the year by your employer is considered paid on each required installment date unless you establish the dates on which withholding occurred and consider such withholding as paid on the dates when actually withheld.

For nonresident individuals, the amount of tax withheld by S corporations, partnerships, limited liability companies, or fiduciaries shall be considered paid on the last day of the organization’s taxable year unless you establish the dates on which all amounts were actually withheld and consider such withholding as paid on the dates when actually withheld.

LINE 18, OVERPAYMENT. Any overpayment of an installment on line 18 in excess of all prior underpayments should be applied as a credit on line 12 against the next installment.

LINES 19-23, PENALTY CALCULATIONS. Complete lines 19 through 23 to determine the amount of the penalty. In determining the date of payment on line 20, use the date of the payment which was applied against the underpayment on line

19.If the payment applied is less than the underpayment, make separate penalty calculations through the date of payment and for the remaining underpayment through the date it is paid, then add the results together and enter on line

22.See the instructions for Federal Form 2210 for more information. The penalty is calculated at 9% per annum for all installments.

SPECIAL RULES FOR FARMERS AND RANCHERS. If your gross income from farming, ranching, or fishing is at least two-thirds of your annual gross income from all sources for 1999 or 2000, and Form 1040N is filed and the Nebraska income tax paid on or before March 1, you are exempt from penalties for underpayment of estimated tax and are not required to file a Form 2210N.

1.How to Figure Your Underpayment. If the gross income test was met but the date for filing and payment of the tax was not, complete lines 24 through 31. If no underpayment is indicated on line 31, do not complete lines 32 and 33.

2.Penalty Calculation. Complete lines 32 and 33 to determine the amount of the penalty which is calculated at 9%.