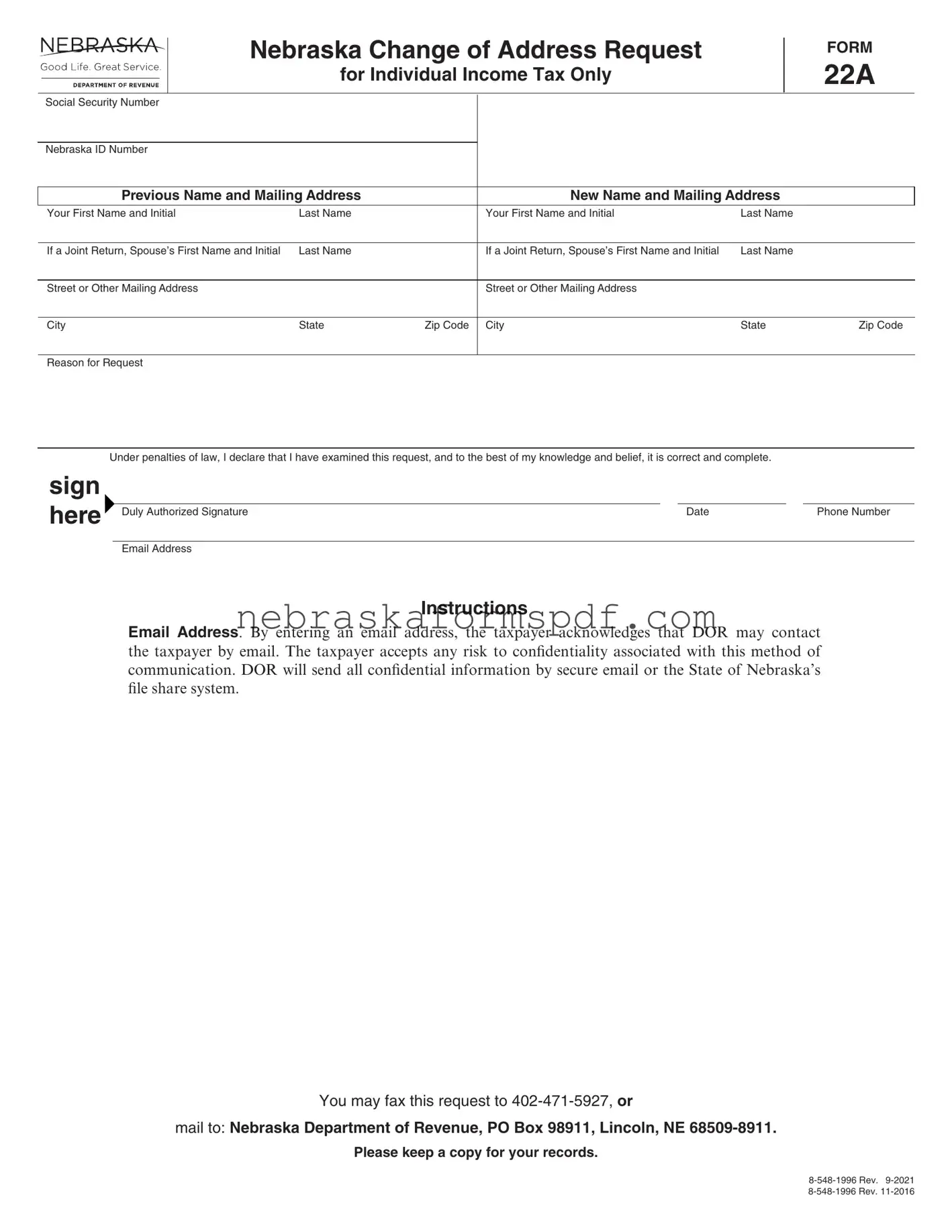

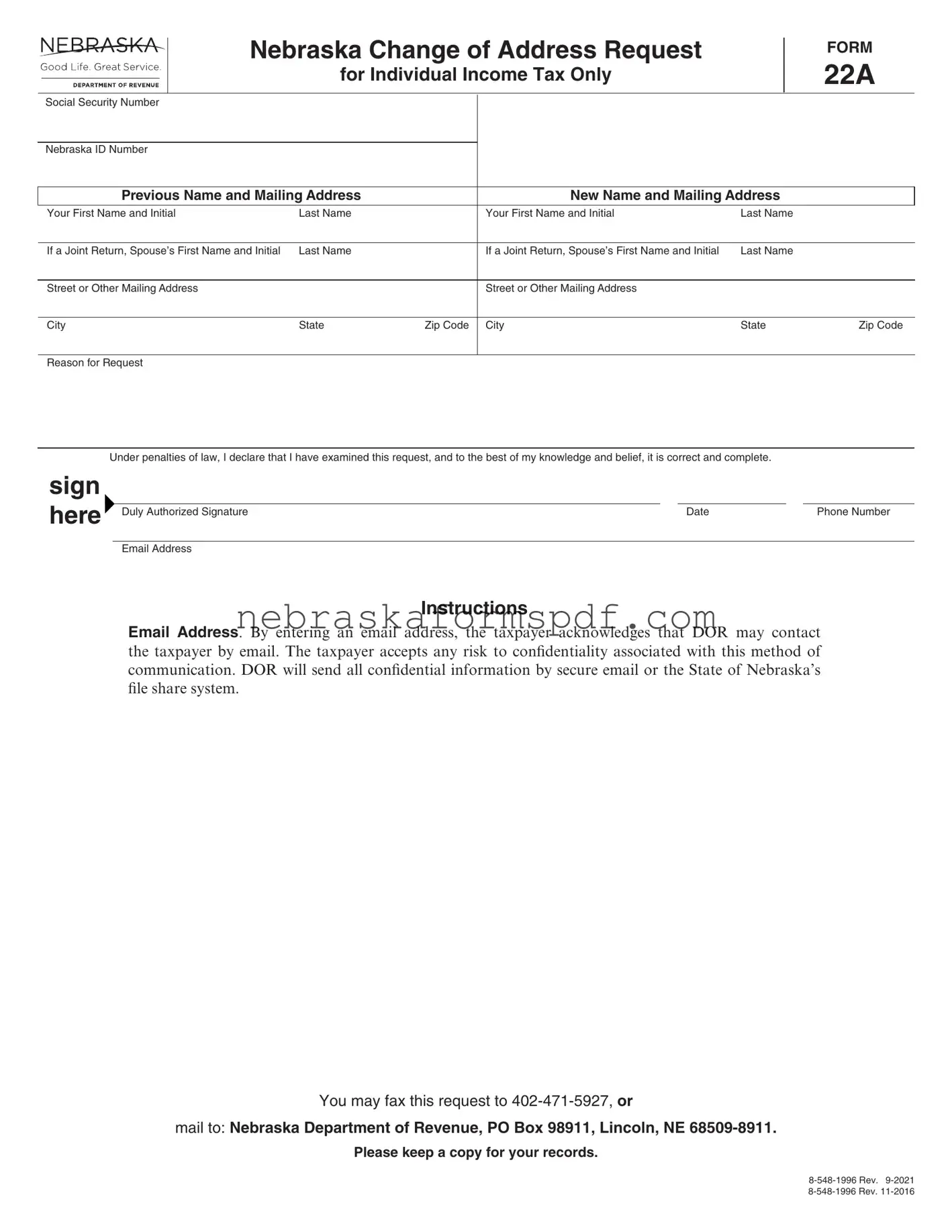

Fill a Valid Nebraska 22A Form

The Nebraska 22A form is designed to facilitate the process for individuals needing to update their address with the Nebraska Department of Revenue specifically for individual income tax purposes. It requires details such as Social Security Number, Nebraska ID Number, both previous and new names and mailing addresses, and, in the case of a joint return, includes spaces for both spouses' names. The form underscores the importance of the accuracy and completeness of the information provided, backed by the declaration that it is done under the penalties of law.

Open Editor Here

Fill a Valid Nebraska 22A Form

Open Editor Here

Open Editor Here

or

Click for PDF Form

Don’t exit with an incomplete form

Finish Nebraska 22A online using a quick, guided process.