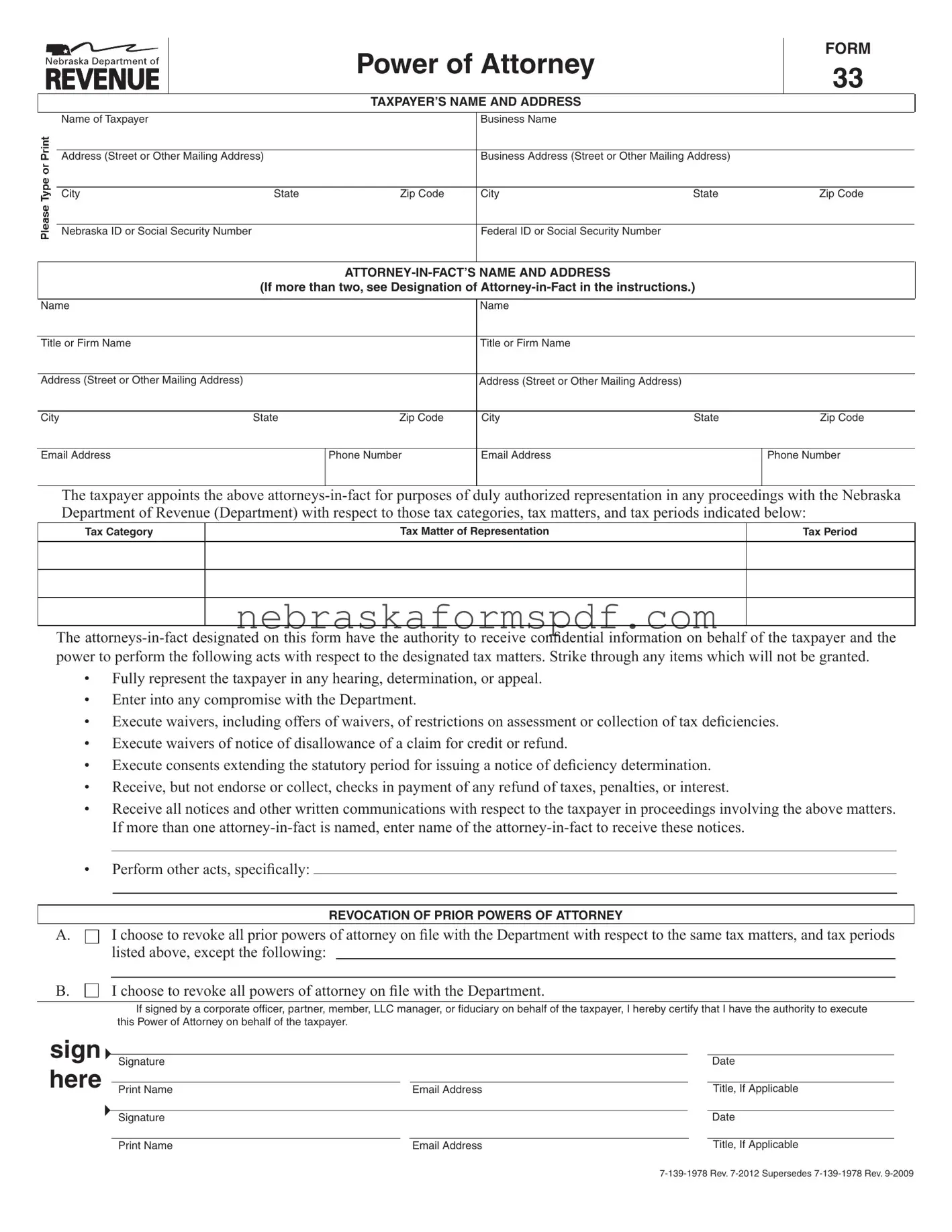

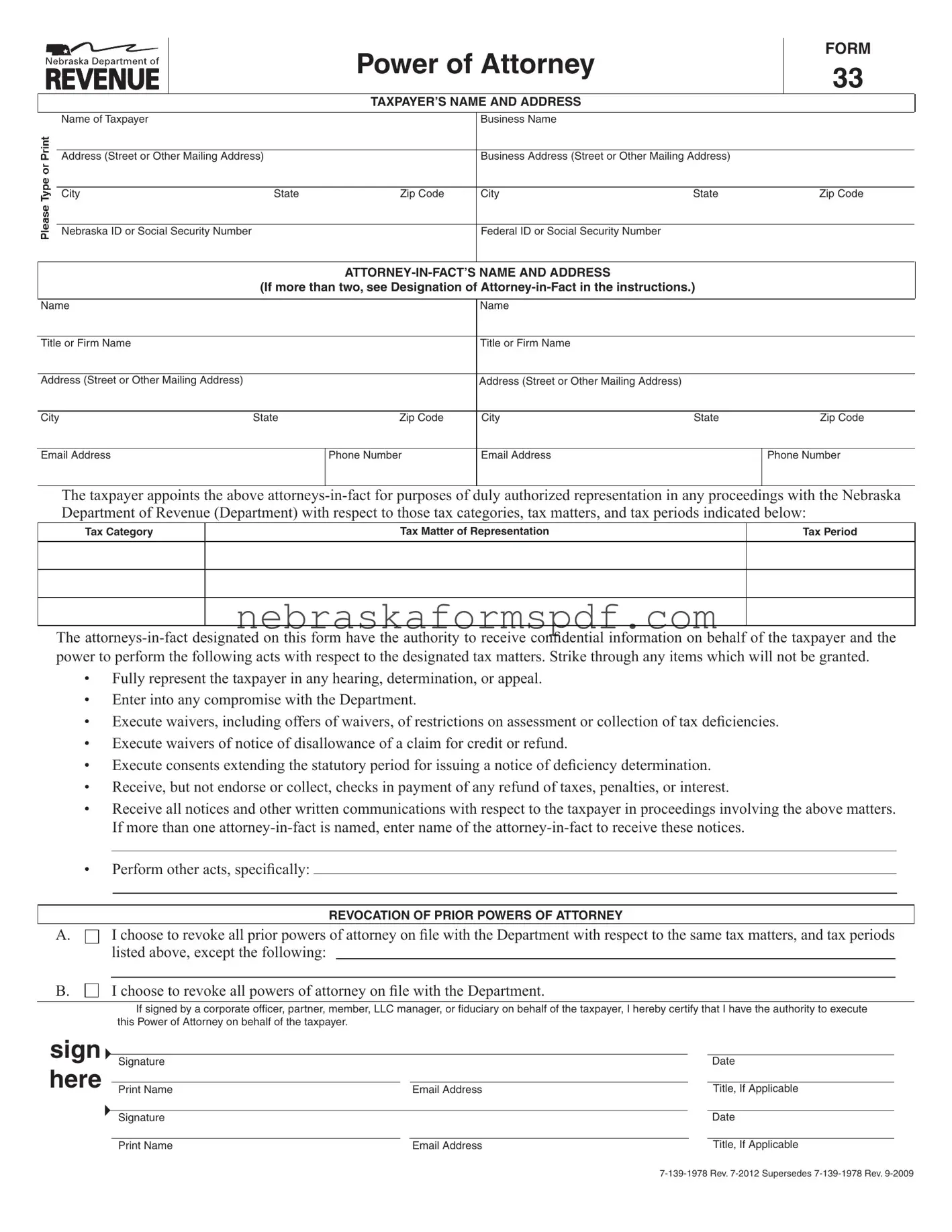

WHO MUST FILE. Any taxpayer who wishes to secure representation by another party in matters before the Nebraska Department of Revenue (Department) with regard to any tax imposed by the tax laws of the State of Nebraska, must ile a Power of Attorney (POA), Form 33. A Form 33 authorizes that party to receive conidential tax information regarding the taxpayer. This form is provided for the taxpayer’s convenience in designating a POA, but it is not the sole form which may be used. The Department will honor all other properly completed and signed POA authorizations.

WHEN AND WHERE TO FILE. The completed Form 33 may be iled any time. This form, or another properly completed and signed POA, must be iled with the Department before any person designated can represent the taxpayer in matters involving disclosure of conidential tax information.

This form, or other appropriate POA, may be scanned and emailed, faxed, or mailed to the Department:

•Email to rev.poa@nebraska.gov;

•Fax to 402-471-5608; or

•Mail to the Nebraska Department of Revenue, PO Box 94818, Lincoln, NE 68509-4818.

TAXPAYER’S NAME AND ADDRESS. If the taxpayer is an individual, a Social Security number must be listed. If a married, iling jointly return was iled, enter both spouses’ Social Security numbers in the spaces provided.

If the taxpayer is a corporation, partnership, or association, enter the name, state and federal ID numbers (if applicable), and the business address. If the Form 33 will be used in a tax matter in the case of a partnership for which the names, addresses, and Social Security numbers or ID numbers have not already been furnished to the Department, these items should be listed on an attached sheet.

If the taxpayer is an estate or trust, enter the name, title, and address of the iduciary, as well as the name and ID number or Social Security number of the taxpayer. If this space is used to list other information, clearly label the change.

DESIGNATION OF ATTORNEY-IN-FACT. An attorney- in-fact is any person who is acting on behalf of another. Enter the appropriate information pertaining to each person to whom representative authority and power is being delegated. Space is provided for listing two appointees. If additional space is required, attach a separate sheet clearly showing the names, addresses, zip codes, and telephone numbers of the additional appointees.

TAX CATEGORY, TAX MATTER, AND TAX PERIOD. Form 33 is designed to clearly express the scope of the authority granted by the taxpayer to any attorneys-in-fact. In the space provided, designate all tax categories, tax matters, and tax periods for which this Form 33 is being iled. The authorization granted must be clearly identiied.

“Tax Category” requires a list of the type of tax, such as “income” or “sales and use.” “Tax Matter of Representation” requires a brief summary of the subjects for which the attorney-in-fact will represent the taxpayer. These may include, but are not limited to: tax assessment resulting from an audit; abatement of penalty; claim for refund; or formal hearing. “Tax Period” requires a designation of a speciic year or time period. Reference can be made to “all years” or “all periods.” As many as three entries may be listed on one form. If the matter relates to an estate tax, enter the date of the decedent’s death instead of a general year or tax period.

AUTHORIZED ACTS. The Form 33 lists several acts which can be performed by the attorney-in-fact. This list is intended to cover the most commonly appointed acts. If the taxpayer does

not wish to authorize the named attorney-in-fact regarding a

particular act which is listed, the taxpayer must strike through the power which is not granted. This is particularly important with respect to correspondence from the Department to the taxpayer regarding the designated tax matters. If the taxpayer wants to receive refund claim approvals or denials, and other notices and written communications, rather than have the attorney-in-fact be the recipient, strike through that authorization. Otherwise, the Department will send notices and other written communications to the designated attorney-in-fact. Notices of deiciency determination and amended notices will be mailed to the taxpayer directly. A copy will be furnished to the designated attorney-in-fact.

If the taxpayer wishes to authorize an act which is not listed, a concise and speciic statement about the additional authorization must be made in the space provided, or a separate signed statement may be attached to the Form 33.

REVOCATION OF PRIOR POWERS OF ATTORNEY. To revoke any POAs previously iled with the Department, choose Box A or B.

Box A. Checking this box allows the taxpayer the option of revoking all POAs on ile with the Department with the exception of those listed on the lines provided (or on a list attached to the Form 33). Check box A and list the names, addresses, and zip codes of the attorneys-in-fact whose representative authority is not revoked. The date of the earlier POA must also be listed. Copies of the earlier POAs which are to remain in effect may be included instead of the list. Be sure to sign the form.

Box B. Checking this box revokes all POAs previously iled with the Department. Check Box B, and sign the form.

If no boxes are checked, all prior POAs will remain in force.

SIGNATURE. The taxpayer must sign and date the form. If spouses ile a married, iling jointly income tax return, which both have signed, then both spouses must sign the Form 33. If only one spouse in a married couple signs Form 33, then a separate Form 33 must be signed by the other spouse. If there is only one spousal signature or a second POA is not signed, then only the person designated by the POA would be authorized to perform the acts authorized by the POA. The nonsigning spouse who has iled a joint return with his or her spouse may still obtain information about, and may discuss issues regarding, the couple’s joint return. However, a person may not authorize another party, or themselves, to receive conidential tax information regarding separate returns iled by the person’s spouse.

Only certain people may represent a taxpayer in a contested case once a hearing oficer is appointed: (1) the taxpayer; (2) a Nebraska attorney; or (3) a non-Nebraska attorney in good standing who partners with a Nebraska lawyer in representation.

If the taxpayer is a partnership, all partners must sign, unless one is duly authorized to act in the name of the partnership. Nebraska has adopted the Uniform Partnership Act of 1998 (Neb. Rev. Stat. §§ 67-401 to 67-467) making each partner a business agent duly authorized to act for any partnership formed in Nebraska. Authorized signatures for nonresident partnerships will be governed by the laws of the state in which the partnership was formed.

If the taxpayer is a corporation or an association, an oficer having authority to bind the entity must sign. The oficer must indicate his or her oficial title on the line provided.

If the taxpayer is a Nebraska limited liability company (LLC), all the members must sign, unless a manager is duly authorized to act in the name of the LLC. The validity of the authorizations made by a foreign LLC will be determined governed by the laws of the state in which the LLC was organized.

here

here