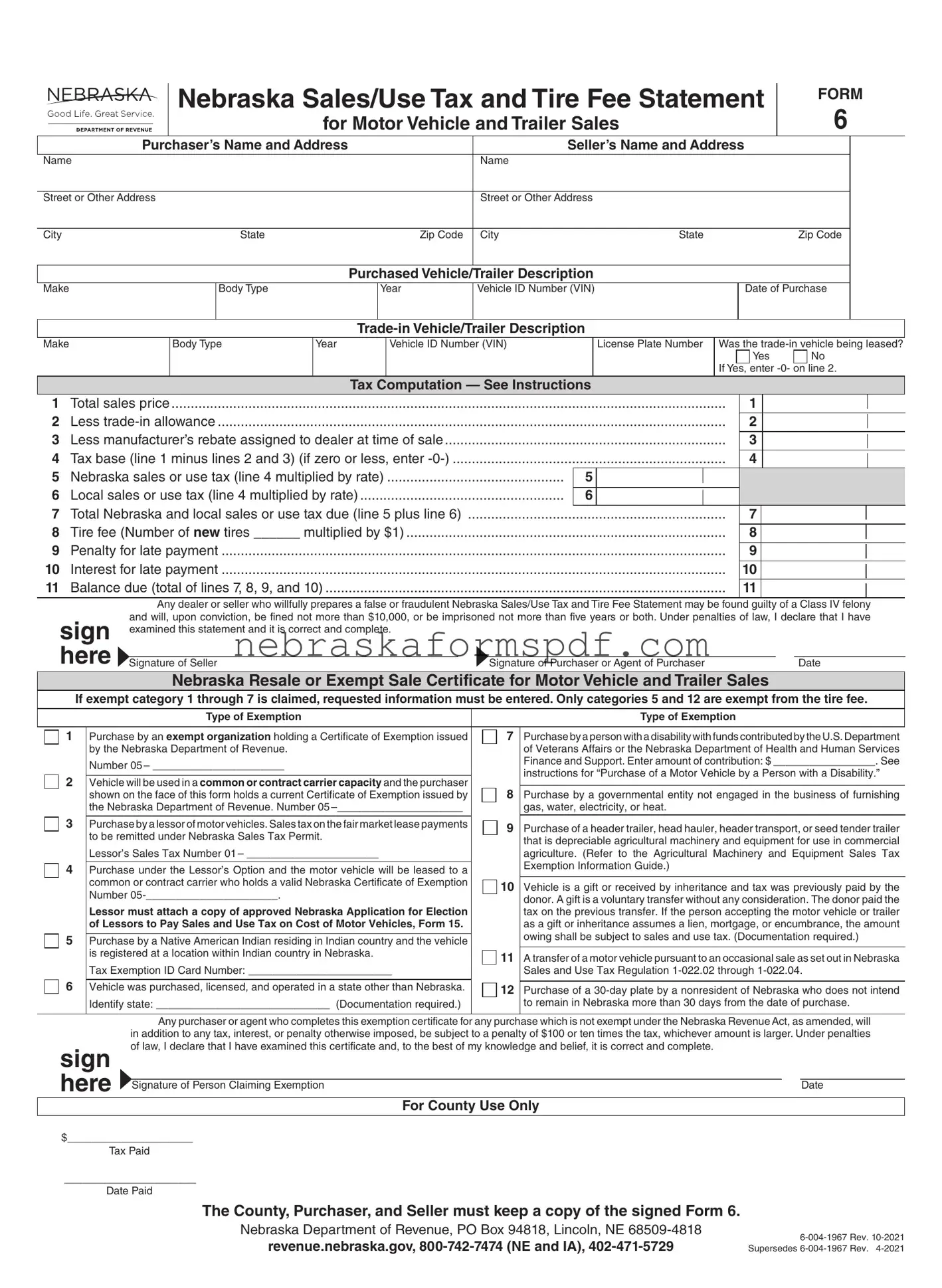

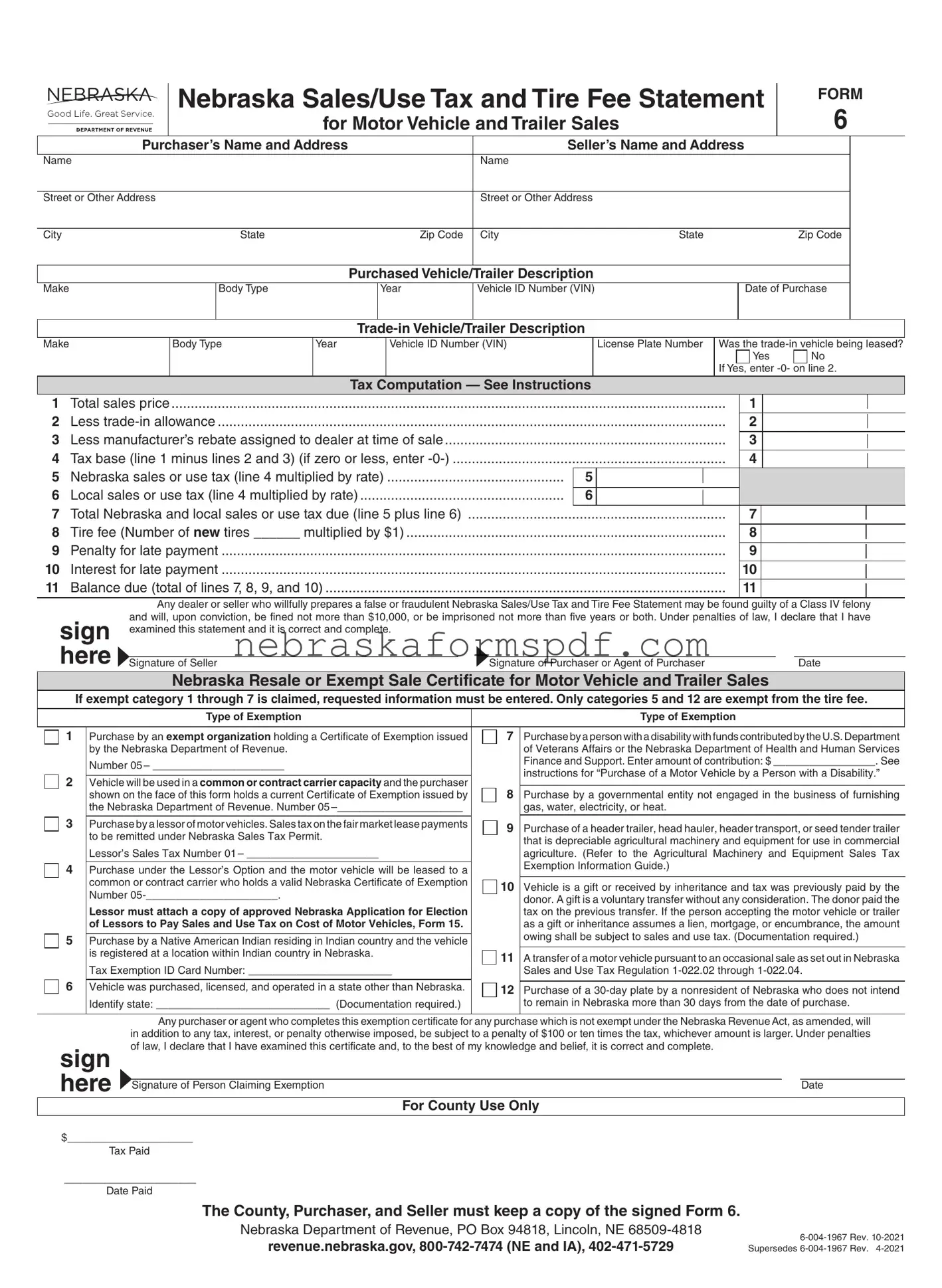

The Nebraska 6 form, known as the Nebraska Sales/Use Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales, is a document required for reporting and paying sales or use tax, and tire fees associated with the purchase of a motor vehicle or trailer. It ensures compliance with Nebraska state tax laws by documenting the transaction details, including the sale price, trade-in value, and applicable taxes and fees.

The form must be presented to the county treasurer, the Department of Motor Vehicles (DMV), or other designated county official within 30 days following the date of purchase. This timeframe helps avoid the assessment of penalties and interest for late payments.

Both individuals and dealers involved in the sale or purchase of a motor vehicle or trailer in Nebraska are required to complete the form. Dealers or sellers need to ensure its accurate completion and submission as part of their sales documentation process, while purchasers must present it when registering the vehicle.

The Total Sales or Use Tax is calculated by subtracting the trade-in allowance and any manufacturer’s rebate from the total sales price, resulting in the tax base. This amount is then multiplied by the applicable tax rate to determine the Nebraska sales or use tax, with local taxes added if applicable.

Exemptions can apply under specific conditions, including but not limited to:

-

Purchases by an exempt organization holding a Certificate of Exemption.

-

Sales to a person with a disability financed by specified agencies.

-

Transactions involving agricultural machinery for commercial use.

-

Vehicles acquired as gifts or through inheritance.

Exemption claims must be substantiated with appropriate documentation.

What is the penalty for late payment?

Penalties and interest are assessed for payments made after 30 days from the purchase date. The rate is statutory and accrues from the due date until the date of payment. If the due date falls on a weekend or holiday, payment can be made on the next business day without incurring additional charges.

Can sales tax paid to another state be credited?

Yes, if a motor vehicle is purchased in another state and sales tax is paid to that state, the amount may be credited against the total state and local use tax due in Nebraska. The vehicle must be registered for the first time in Nebraska, and the credit applies only if the other state has tax reciprocity with Nebraska.

For trade-ins to be deductible, the vehicle must be titled in the purchaser’s name or that of their parent, guardian, or child. The trade-in value is deducted from the total sales price before calculating the tax due. Leased vehicles do not qualify for a trade-in allowance unless the lease buy-out was previously taxed.

What happens in case of underpayment?

In cases of underpayment on the form, the discrepancy must be reported on an Amended Nebraska Sales/Use Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales, Form 6XN. This form is available at county treasurer’s offices and through the Nebraska Department of Revenue.