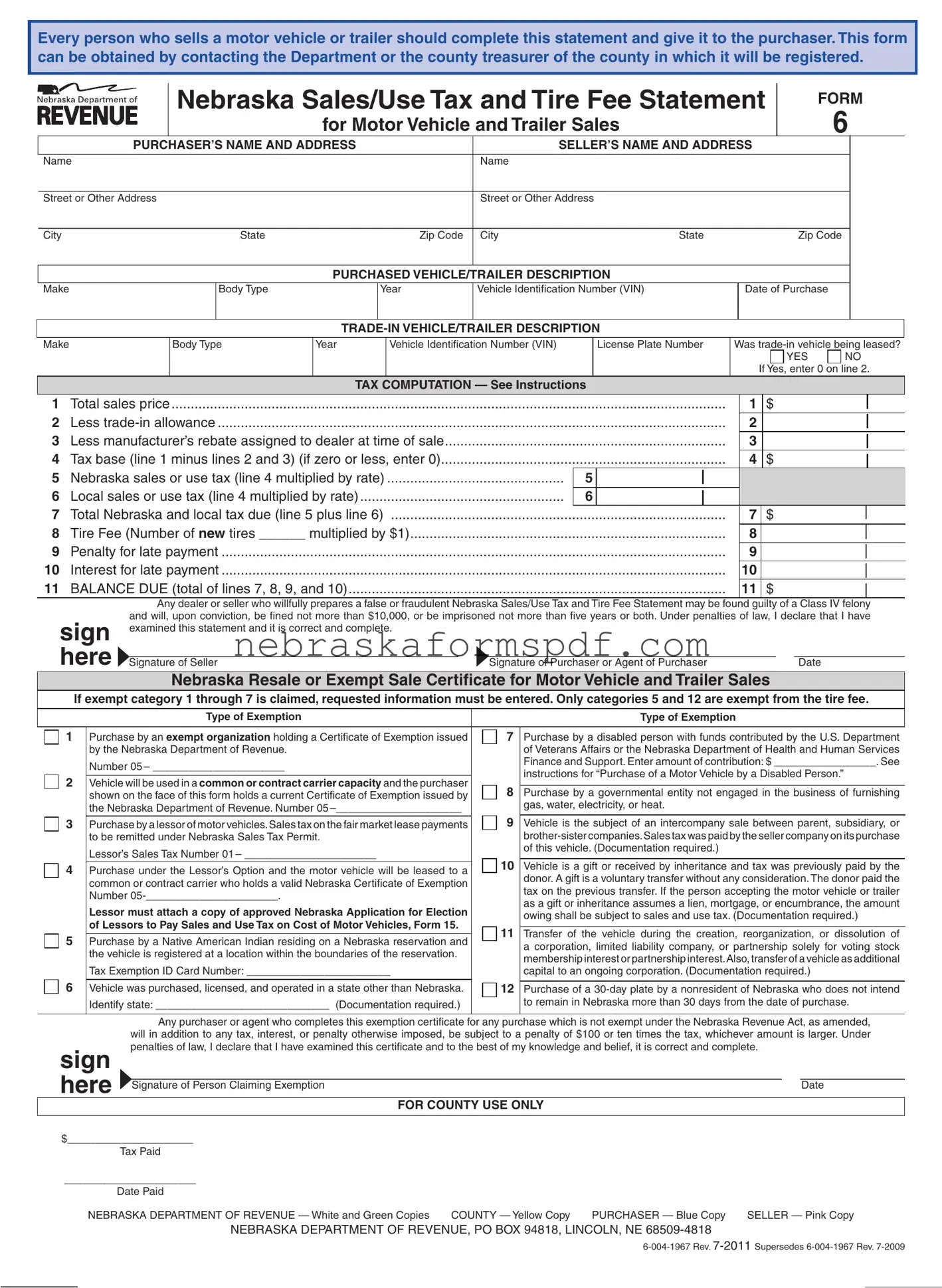

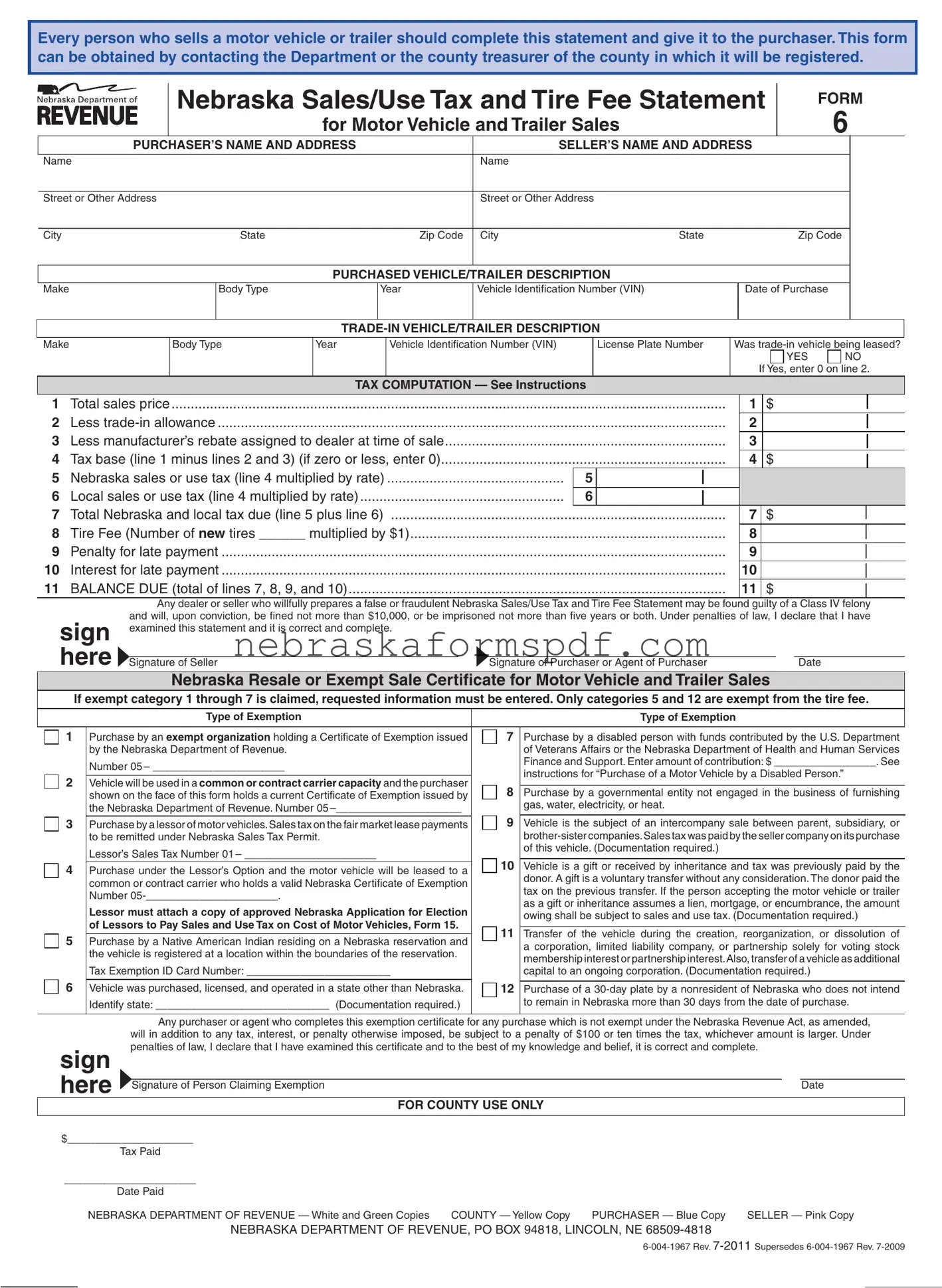

Any dealer or seller who willfully prepares a false or fraudulent Nebraska Sales/Use Tax and Tire Fee Statement may be found guilty of a Class IV felony and will, upon conviction, be fined not more than $10,000, or be imprisoned not more than five years or both. Under penalties of law, I declare that I have

If exempt category 1 through 7 is claimed, requested information must be entered. Only categories 5 and 12 are exempt from the tire fee.

|

|

|

|

|

|

|

Type of Exemption |

|

|

|

|

|

|

Type of Exemption |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Purchase by an exempt organization holding a Certificate of Exemption issued |

7 |

Purchase by a disabled person with funds contributed by the U.S. Department |

|

|

|

|

|

by the Nebraska Department of Revenue. |

|

|

|

|

|

of Veterans Affairs or the Nebraska Department of Health and Human Services |

|

|

|

|

|

Number 05 – ______________________ |

|

|

|

|

|

Finance and Support. Enter amount of contribution: $ _________________. See |

|

|

|

|

|

|

|

|

|

|

instructions for “Purchase of a Motor Vehicle by a Disabled Person.” |

|

2 |

|

|

|

|

|

|

|

|

|

Vehicle will be used in a common or contract carrier capacity and the purchaser |

8 |

|

|

|

|

|

|

|

Purchase by a governmental entity not engaged in the business of furnishing |

|

|

|

|

|

shown on the face of this form holds a current Certificate of Exemption issued by |

|

|

|

|

|

|

|

|

|

gas, water, electricity, or heat. |

|

|

|

|

|

|

|

|

the Nebraska Department of Revenue. Number 05 –_____________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Purchase by a lessor of motor vehicles. Sales tax on the fair market lease payments |

9 |

Vehicle is the subject of an intercompany sale between parent, subsidiary, or |

|

|

|

|

|

to be remitted under Nebraska Sales Tax Permit. |

|

|

|

|

|

brother-sister companies.Sales tax was paid by the seller company on its purchase |

|

|

|

|

|

Lessor’s Sales Tax Number 01 – ______________________ |

|

|

|

|

|

of this vehicle. (Documentation required.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

10 |

Vehicle is a gift or received by inheritance and tax was previously paid by the |

|

Purchase under the Lessor’s Option and the motor vehicle will be leased to a |

|

|

|

|

|

|

donor. A gift is a voluntary transfer without any consideration. The donor paid the |

|

|

|

|

|

common or contract carrier who holds a valid Nebraska Certificate of Exemption |

|

|

|

|

|

|

|

|

|

|

|

|

|

tax on the previous transfer. If the person accepting the motor vehicle or trailer |

|

|

|

|

|

Number 05-______________________. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

as a gift or inheritance assumes a lien, mortgage, or encumbrance, the amount |

|

|

|

|

|

Lessor must attach a copy of approved Nebraska Application for Election |

|

|

|

|

|

|

|

|

|

|

|

|

|

owing shall be subject to sales and use tax. (Documentation required.) |

|

|

|

|

|

of Lessors to Pay Sales and Use Tax on Cost of Motor Vehicles, Form 15. |

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

Transfer of |

the vehicle during the creation, |

reorganization, or dissolution of |

|

|

|

|

Purchase by a Native American Indian residing on a Nebraska reservation and |

|

|

|

|

|

|

|

|

a corporation, limited liability company, or partnership solely for voting stock |

|

|

|

|

|

the vehicle is registered at a location within the boundaries of the reservation. |

|

|

|

|

|

|

|

|

|

|

|

|

|

membership interest or partnership interest.Also, transfer of a vehicle as additional |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Exemption ID Card Number: ________________________ |

|

|

|

|

|

capital to an ongoing corporation. (Documentation required.) |

|

|

|

|

6 |

Vehicle was purchased, licensed, and operated in a state other than Nebraska. |

12 |

Purchase of a 30-day plate by a nonresident of Nebraska who does not intend |

|

|

|

|

|

Identify state: _____________________________ (Documentation required.) |

|

|

|

|

to remain in Nebraska more than 30 days from the date of purchase. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Any purchaser or agent who completes this exemption certificate for any purchase which is not exempt under the Nebraska Revenue Act, as amended, |

|

|

|

|

|

|

|

will in addition to any tax, interest, or penalty otherwise imposed, be subject to a penalty of $100 or ten times the tax, whichever amount is larger. Under |

|

|

|

|

sign |

|

penalties of law, I declare that I have examined this certificate and to the best of my knowledge and belief, it is correct and complete. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of Person Claiming Exemption |

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR COUNTY USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$_____________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Paid |

|

|

|

|

|

|

|

|

|

|

|

______________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date Paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NEBRASKA DEPARTMENT OF REVENUE — White and Green Copies |

COUNTY — Yellow Copy |

PURCHASER — Blue Copy |

SELLER — Pink Copy |