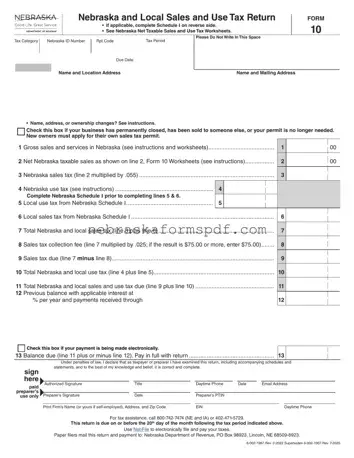

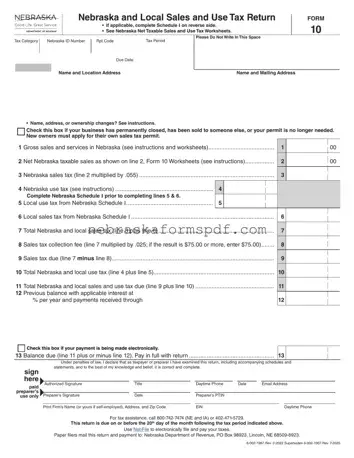

The Nebraska 10 form is an essential document for businesses in Nebraska, serving as the Sales and Use Tax Return. It is designed for reporting and remitting the sales tax collected from customers, as well as use tax owed on...

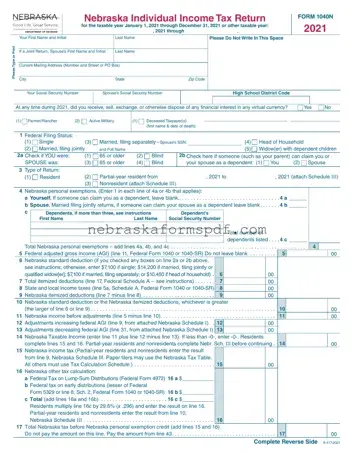

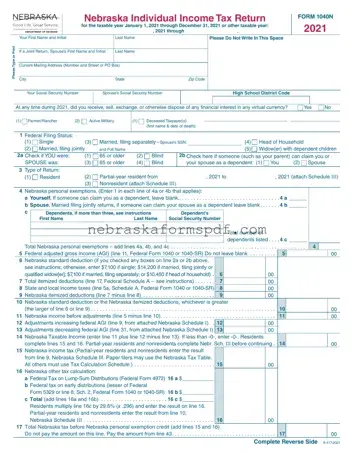

The Nebraska 1040N form is the document used for state residents to file their annual income tax for the taxable year, covering periods from January 1, 2022, through December 31, 2022, or other specified taxable years. It outlines the process...

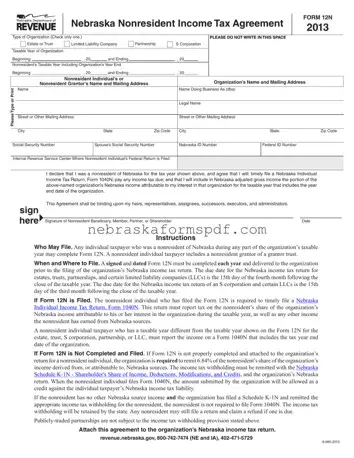

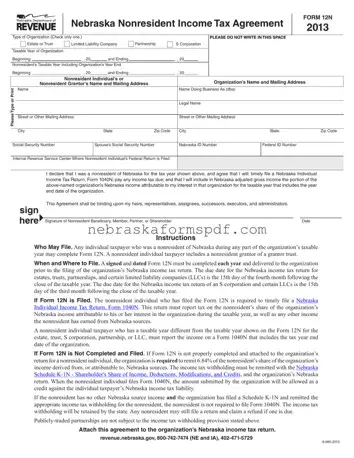

The Nebraska 12N form, known as the Nebraska Nonresident Income Tax Agreement, is a vital document for any nonresident individual who earns income through certain types of organizations within Nebraska. Designed for nonresidents involved with estates, trusts, limited liability companies,...

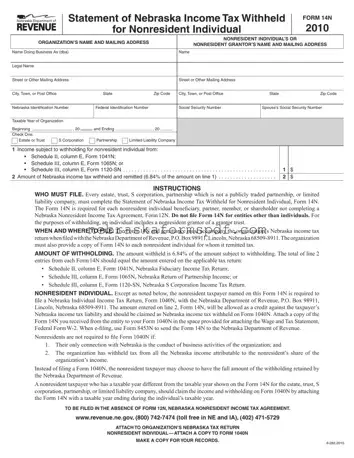

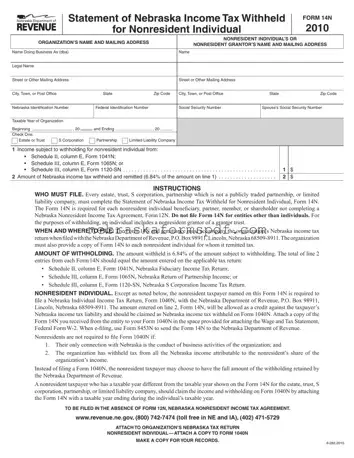

The Nebraska 14N form, officially known as the Statement of Nebraska Income Tax Withheld for Nonresident Individual, is a crucial document for estates, trusts, S corporations, partnerships, and limited liability companies that withhold income tax for nonresident individuals. It serves...

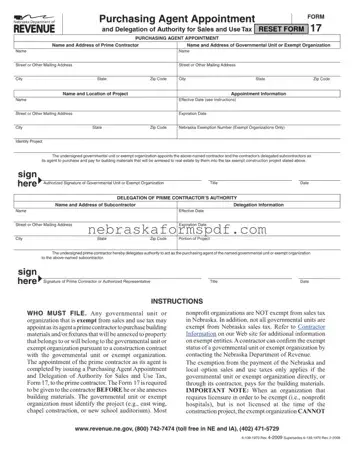

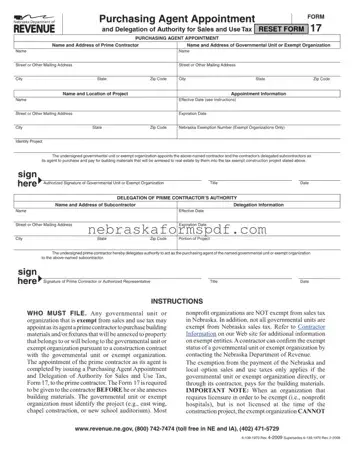

The Nebraska 17 form is a crucial document for initiating a court case in Nebraska. It serves as the foundation for any legal actions individuals wish to pursue in court. The form's precise usage varies depending on the type of...

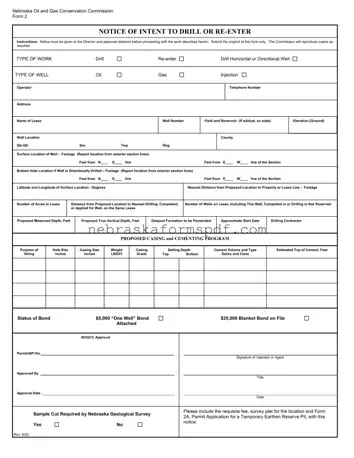

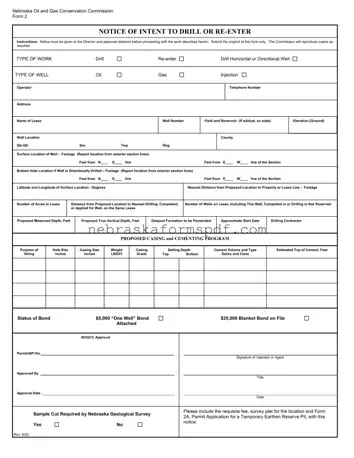

The Nebraska Oil and Gas Conservation Commission Form 2, also known as the Notice of Intent to Drill or Re-Enter, plays a crucial role in the state's oil and gas sector. It outlines the requirements for notifying the Director and...

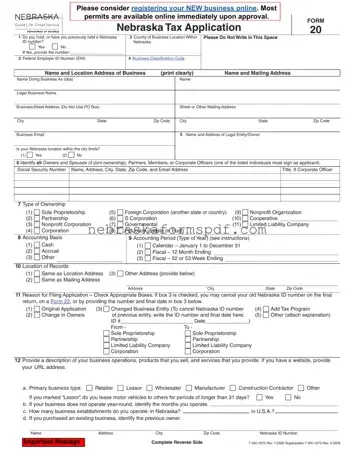

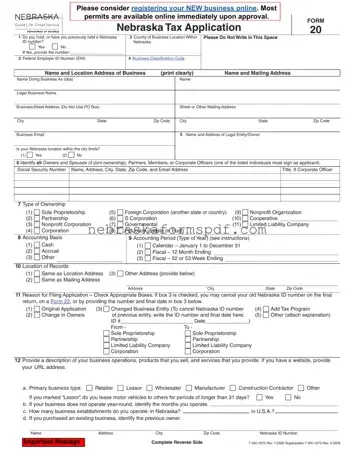

The Nebraska 20 form is an essential document for businesses in Nebraska, serving as the primary tax application for new businesses within the state. It encompasses a vast array of business details, including federal employer ID numbers (EIN), business classification...

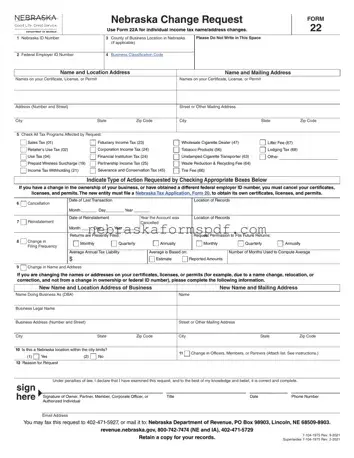

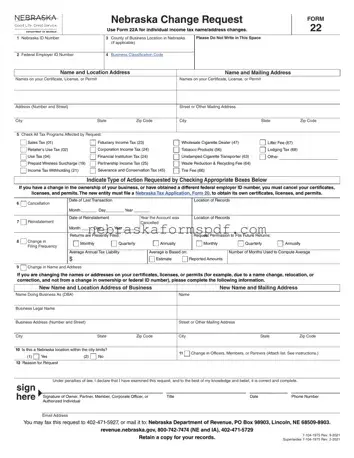

The Nebraska 22 form is a comprehensive document designed for taxpayers in Nebraska to request changes related to their tax certificates, licenses, or permits, including name and address adjustments, corrections, and cancellation or reinstatement of these documents. Geared toward facilitating...

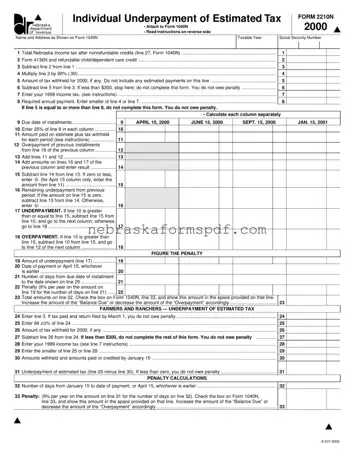

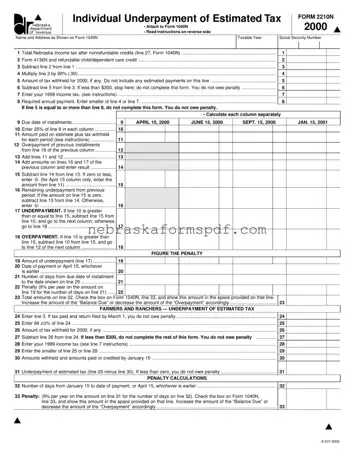

The Nebraska 2210N form is designed for individuals who need to calculate if they have underpaid their estimated tax throughout the year. It serves as an attachment to the Nebraska Individual Income Tax Return, Form 1040N, to determine the penalty...

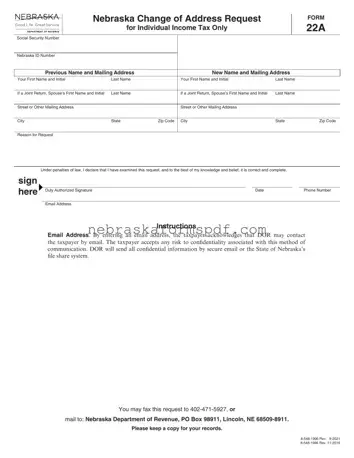

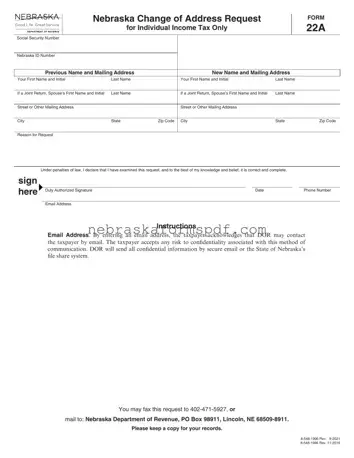

The Nebraska 22A form is designed to facilitate the process for individuals needing to update their address with the Nebraska Department of Revenue specifically for individual income tax purposes. It requires details such as Social Security Number, Nebraska ID Number,...

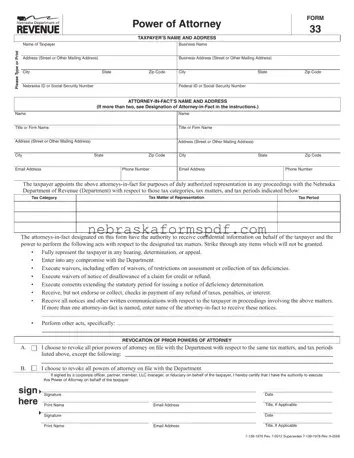

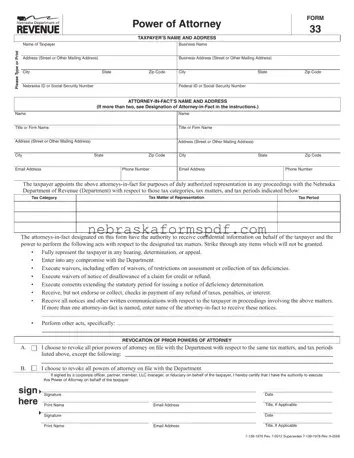

The Nebraska 33 form, officially named the Power of Attorney (POA) form, facilitates taxpayers in appointing a representative for dealings with the Nebraska Department of Revenue on matters related to state tax laws. This authorization enables a designated attorney-in-fact to...

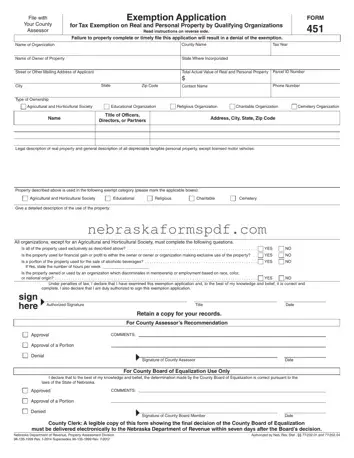

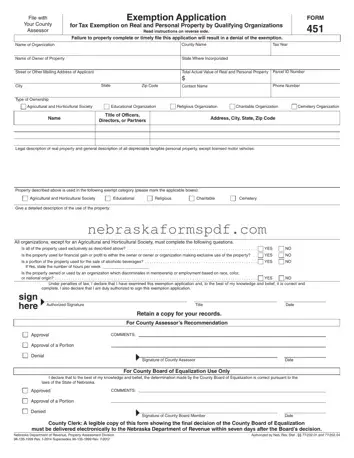

The Nebraska 451 form is a crucial document for qualifying organizations seeking tax exemption on real and personal property within the state. This comprehensive form requires detailed information about the organization, the property in question, and its use, to determine...