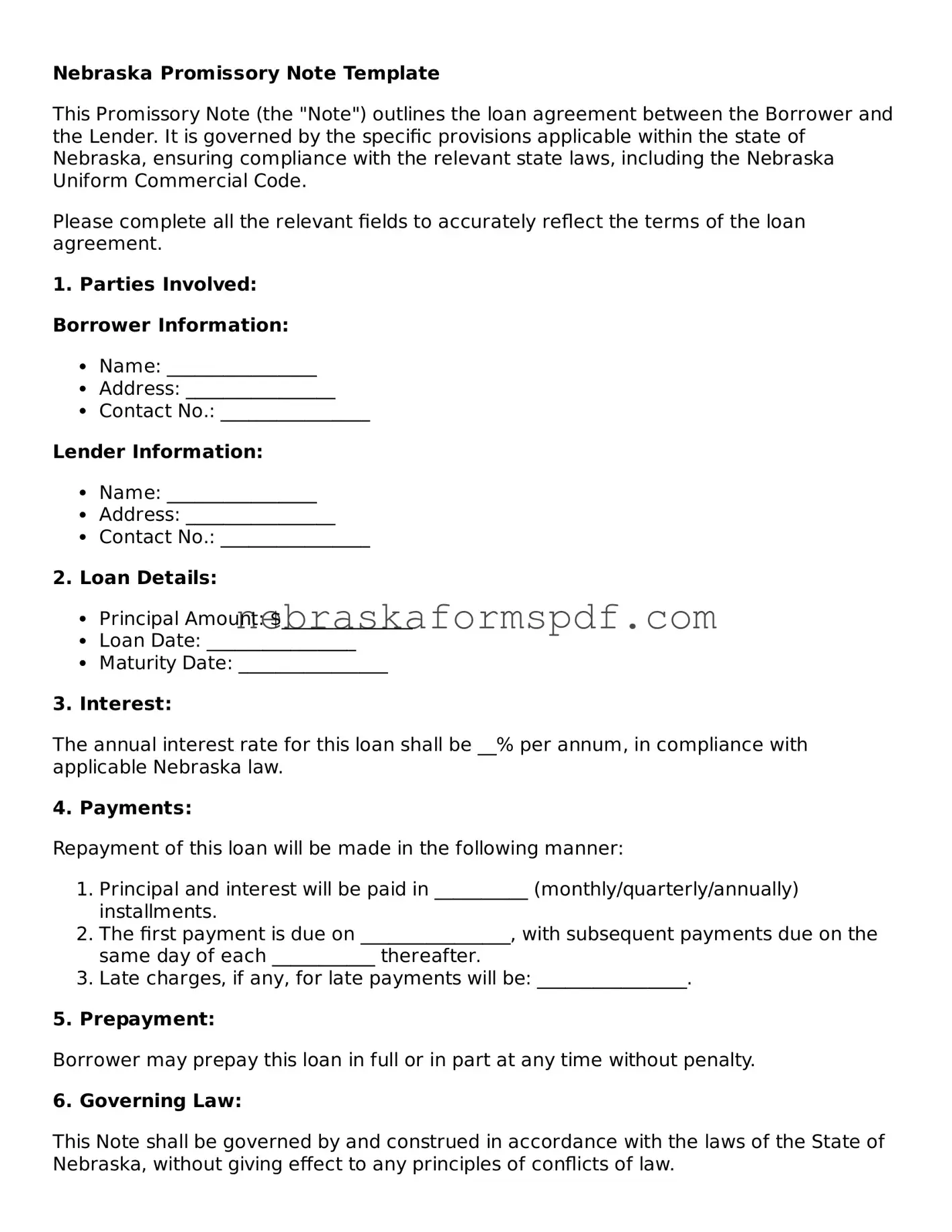

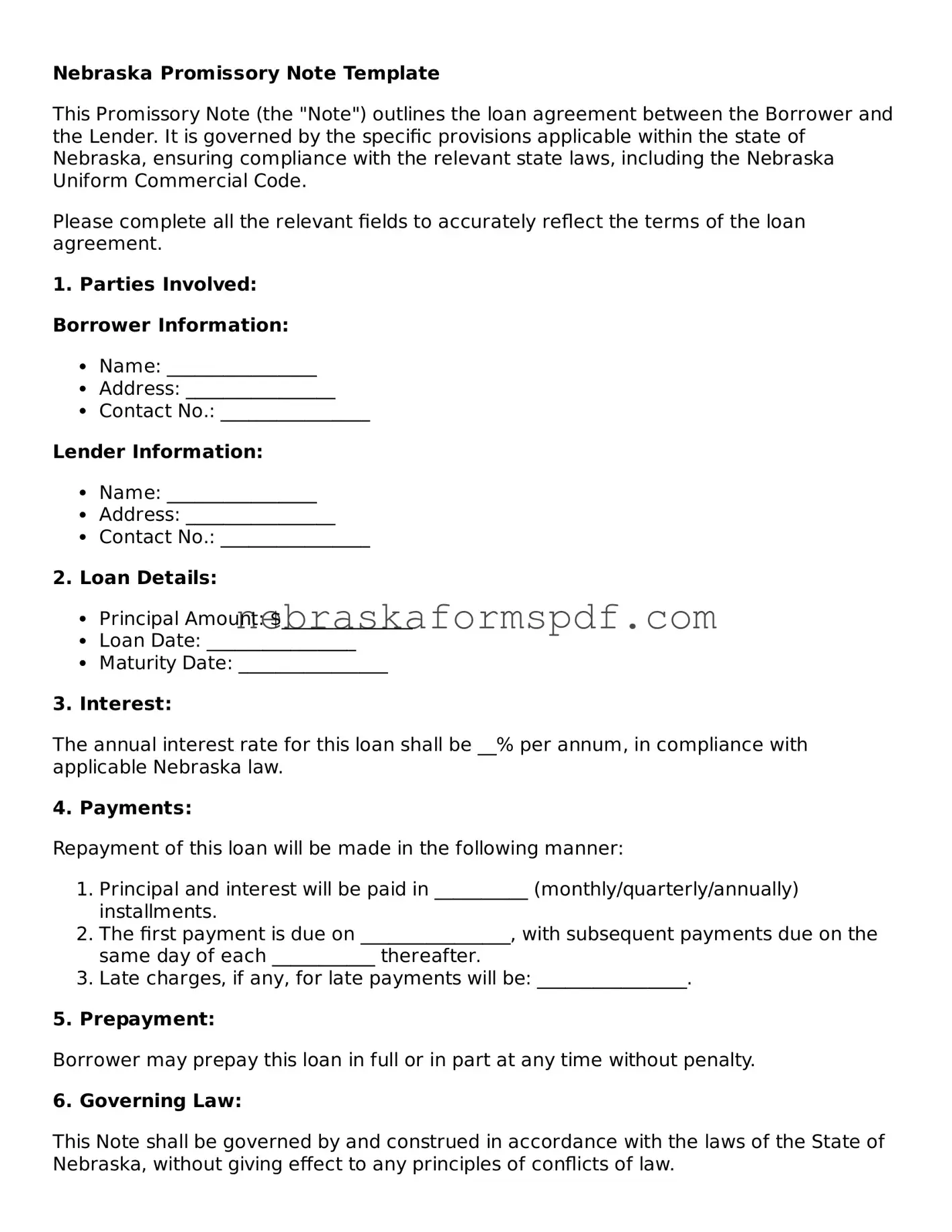

Fillable Nebraska Promissory Note Template

A Nebraska Promissory Note form is a legal document outlining a loan's repayment schedule, interest rate, and the obligations of the borrower to the lender. It serves as a formal promise by the borrower to repay the debt under specified conditions, creating a binding agreement in the state of Nebraska. This instrument is crucial in ensuring both parties have a clear understanding of the terms of the loan, safeguarding their interests and presenting a methodical approach to financial transactions.

Open Editor Here

Fillable Nebraska Promissory Note Template

Open Editor Here

Open Editor Here

or

Click for PDF Form

Don’t exit with an incomplete form

Finish Promissory Note online using a quick, guided process.