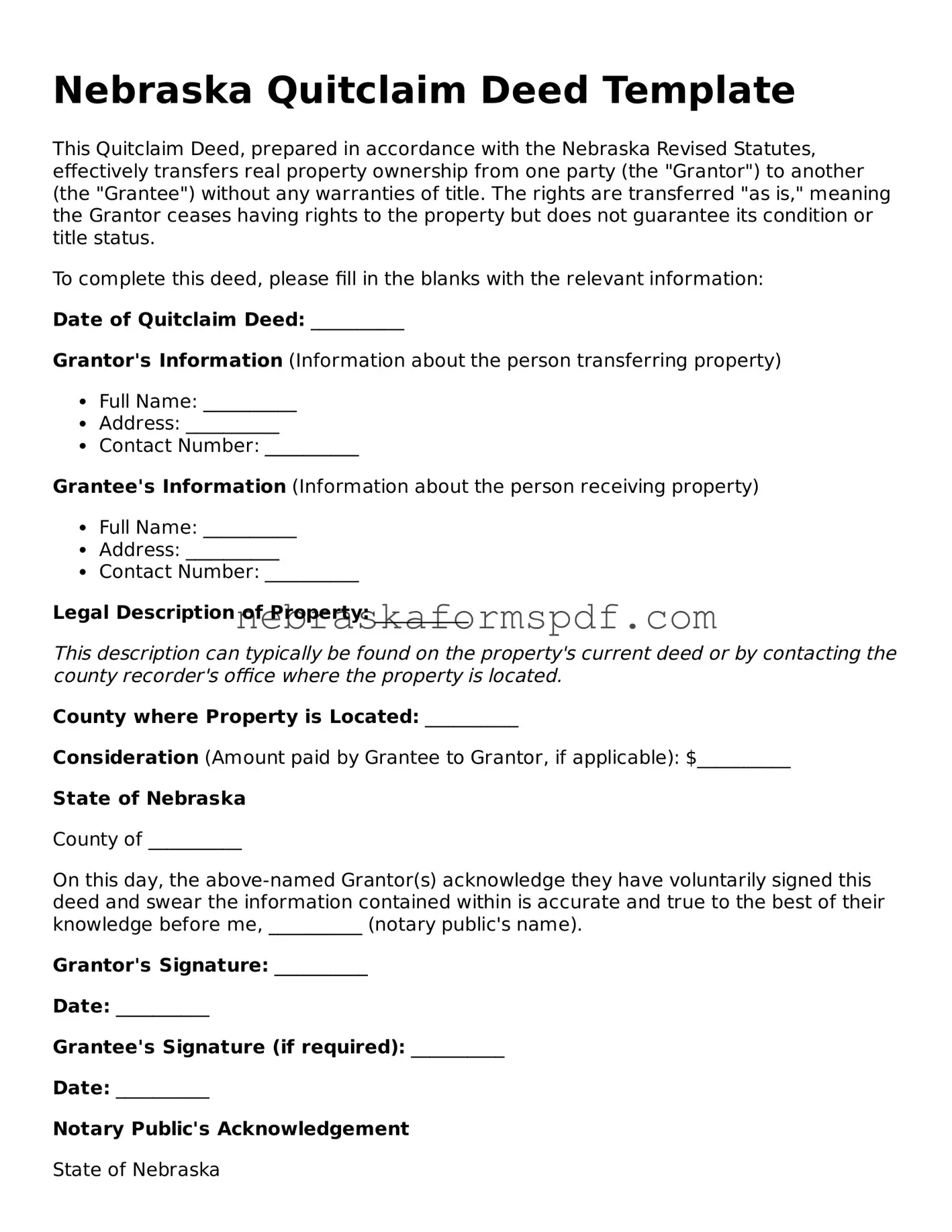

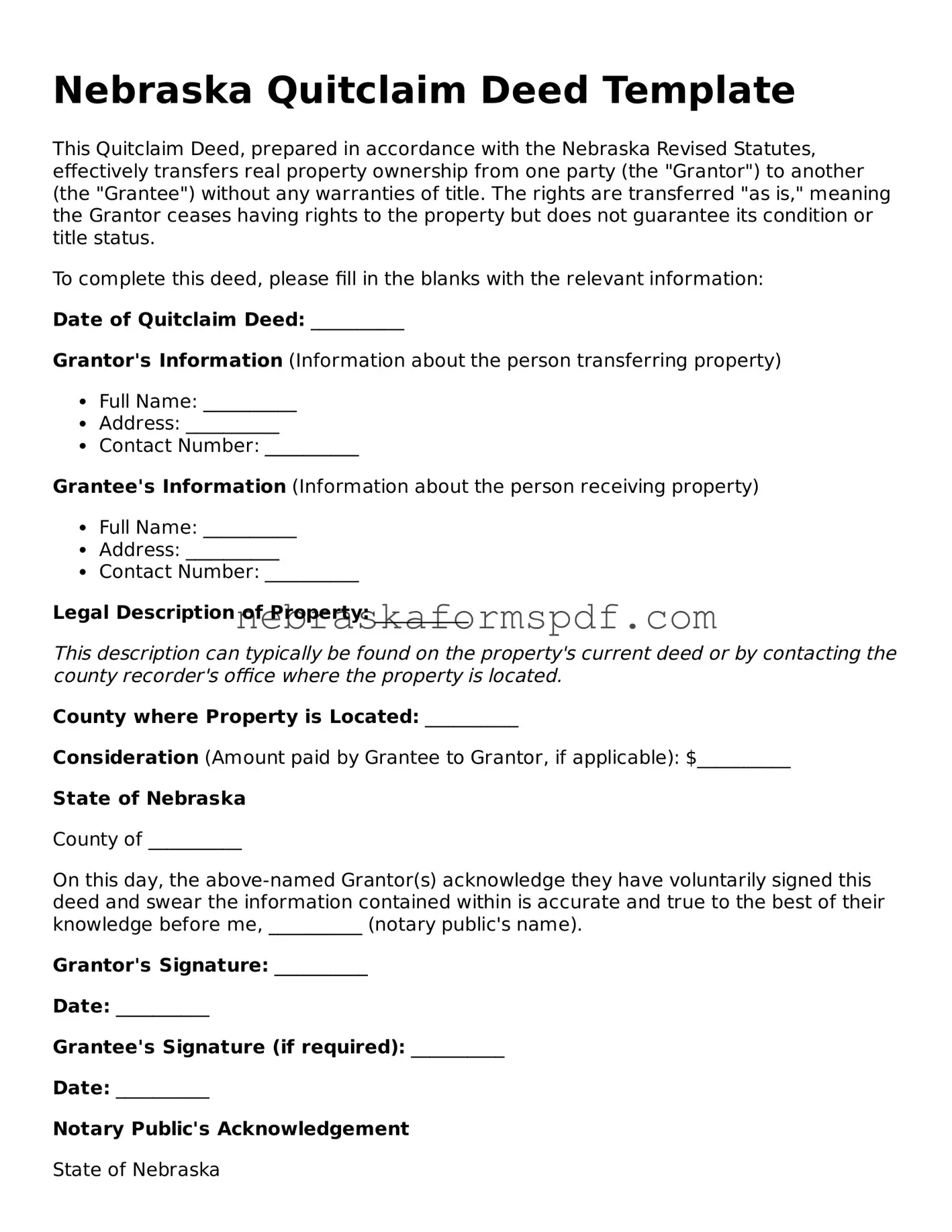

Fillable Nebraska Quitclaim Deed Template

A Nebraska Quitclaim Deed form serves as a legal document used to transfer interest in real property from one person or entity to another, with no warranties regarding the title's condition. This type of deed is particularly common in situations where the property is gifted or transferred between family members, and in instances where the seller does not guarantee the title is free of claims. It is a straightforward method for transferring property, but it does involve certain risks due to the lack of guarantees.

Open Editor Here

Fillable Nebraska Quitclaim Deed Template

Open Editor Here

Open Editor Here

or

Click for PDF Form

Don’t exit with an incomplete form

Finish Quitclaim Deed online using a quick, guided process.