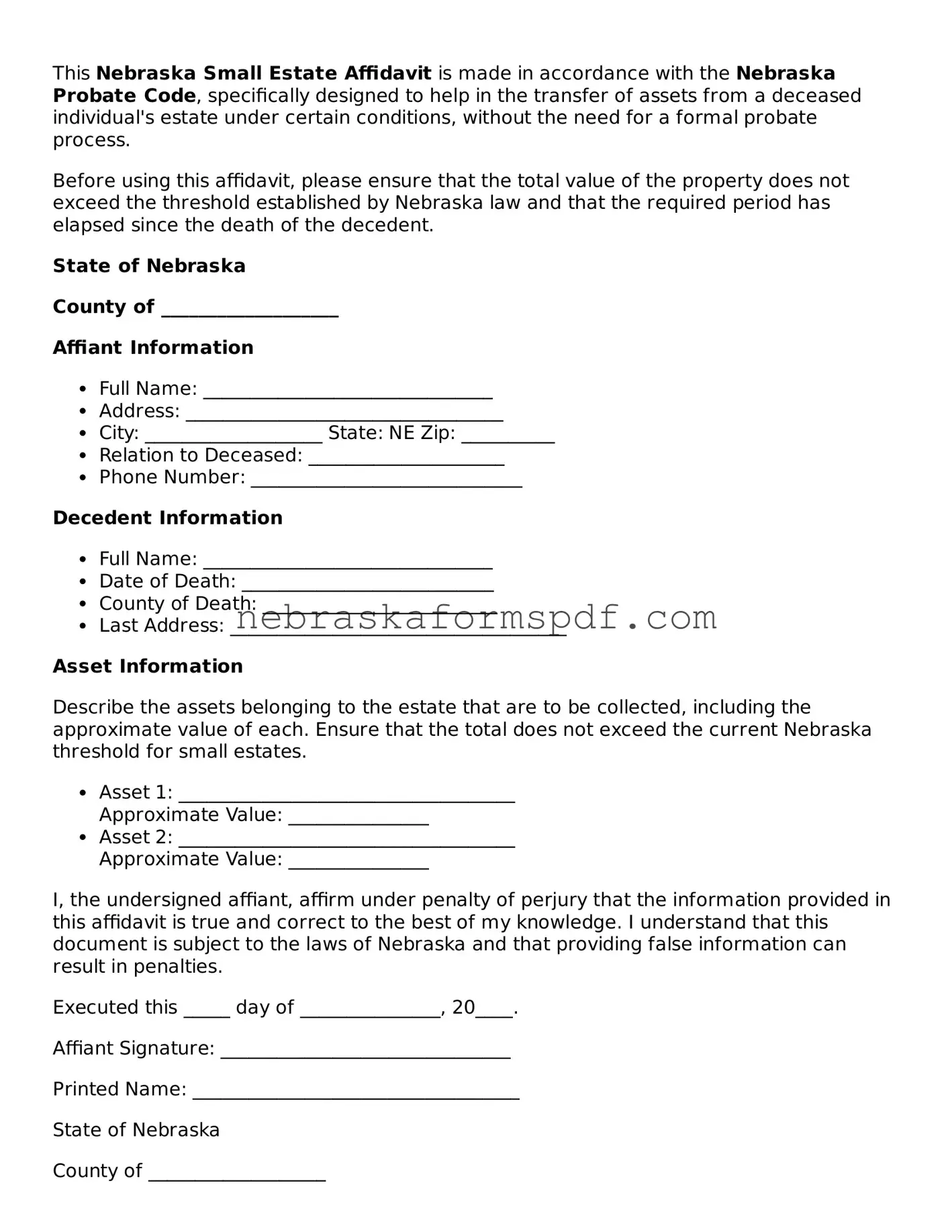

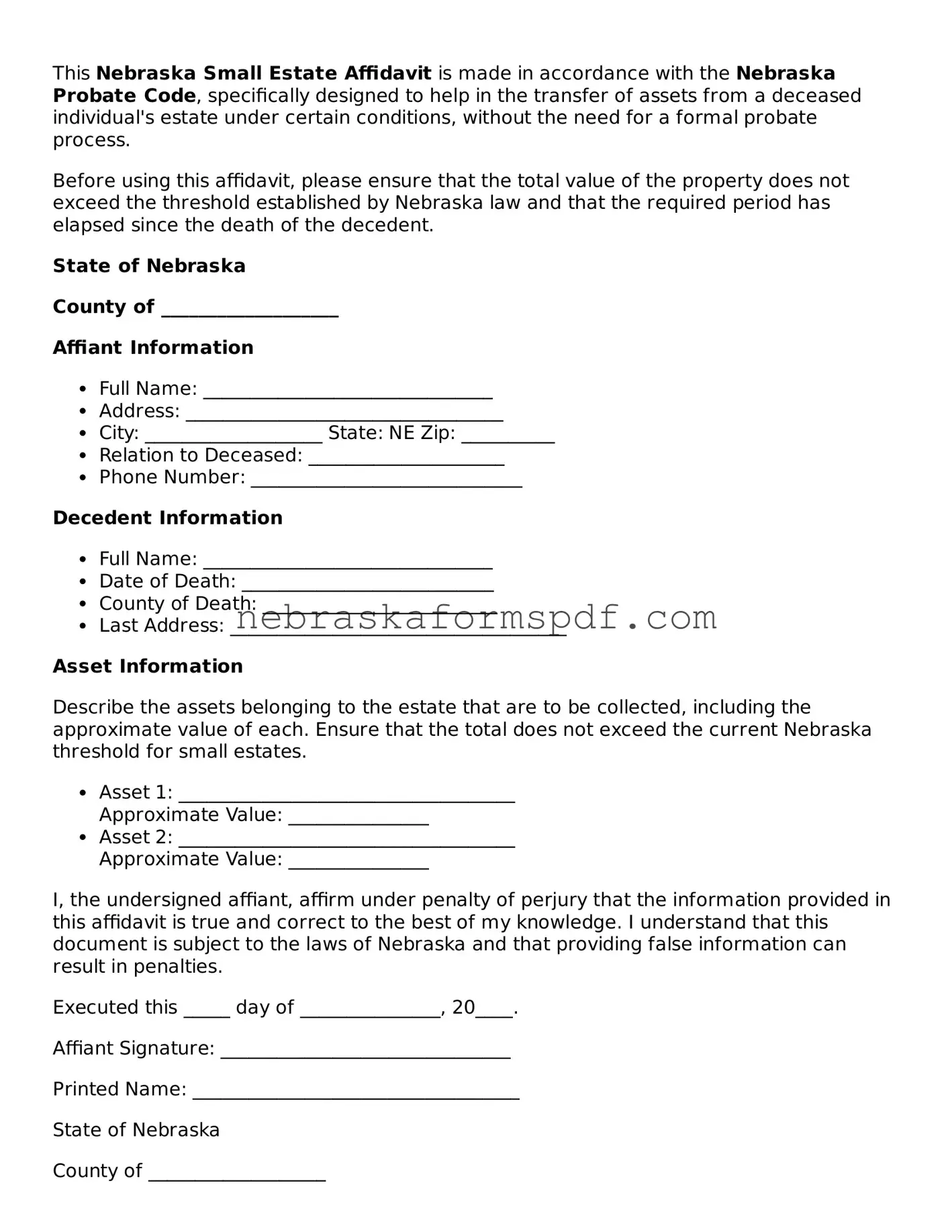

Fillable Nebraska Small Estate Affidavit Template

The Nebraska Small Estate Affidavit form is a legal document used to simplify the process of estate distribution for estates below a specific value threshold, bypassing the need for formal probate. It allows successors to claim property of the deceased directly from holders by swearing to their rightful inheritance under oath. This document streamlines the transfer of assets, making it a critical tool for small estate management in Nebraska.

Open Editor Here

Fillable Nebraska Small Estate Affidavit Template

Open Editor Here

Open Editor Here

or

Click for PDF Form

Don’t exit with an incomplete form

Finish Small Estate Affidavit online using a quick, guided process.