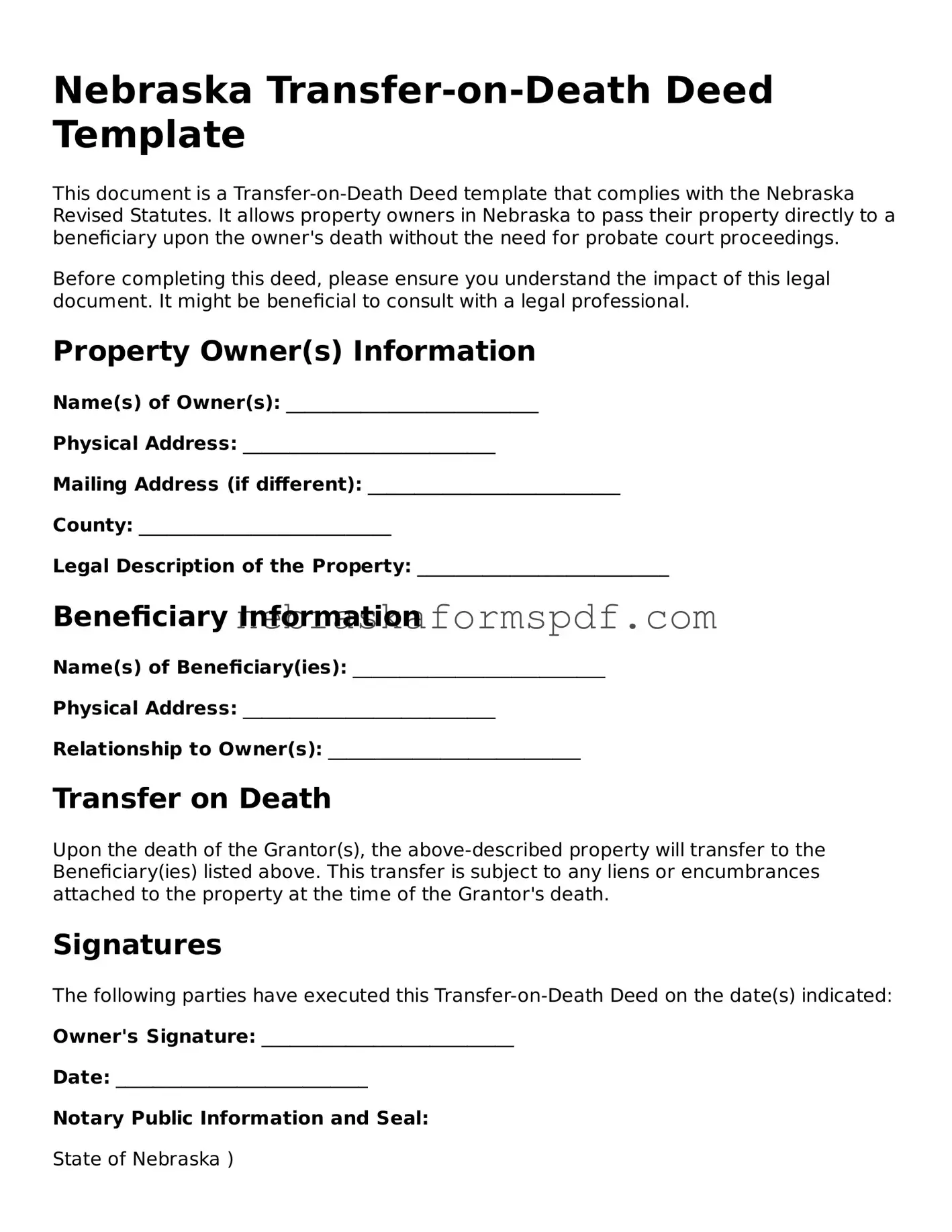

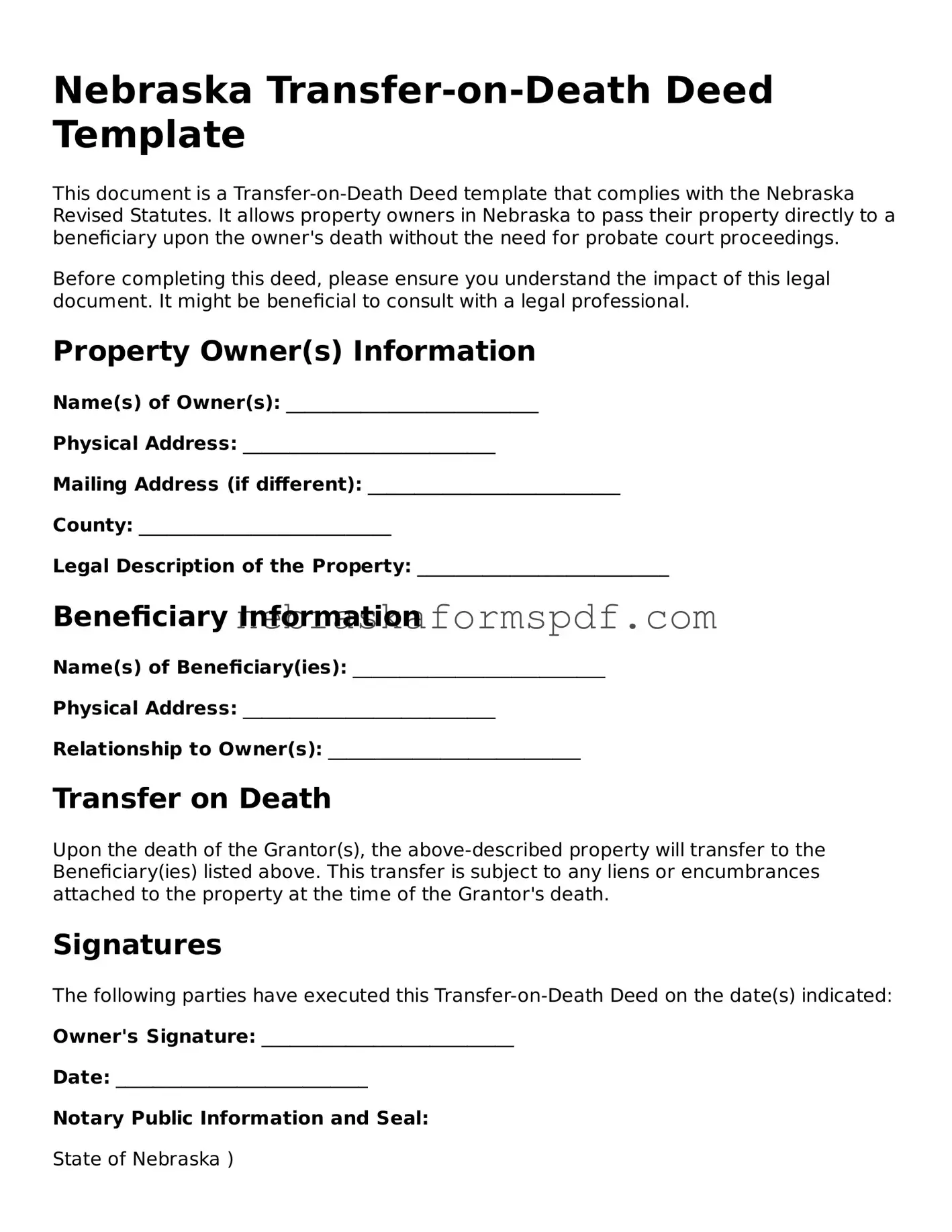

Fillable Nebraska Transfer-on-Death Deed Template

The Nebraska Transfer-on-Death Deed form allows a property owner to pass on their property to a beneficiary upon their death without going through probate. This form simplifies the process of transferring real estate, ensuring that the intended person receives the property directly. It serves as a useful tool for estate planning, providing peace of mind for property owners and their loved ones.

Open Editor Here

Fillable Nebraska Transfer-on-Death Deed Template

Open Editor Here

Open Editor Here

or

Click for PDF Form

Don’t exit with an incomplete form

Finish Transfer-on-Death Deed online using a quick, guided process.